Uncategorized

A BJP victory and the Stock Market: what to expect this monday

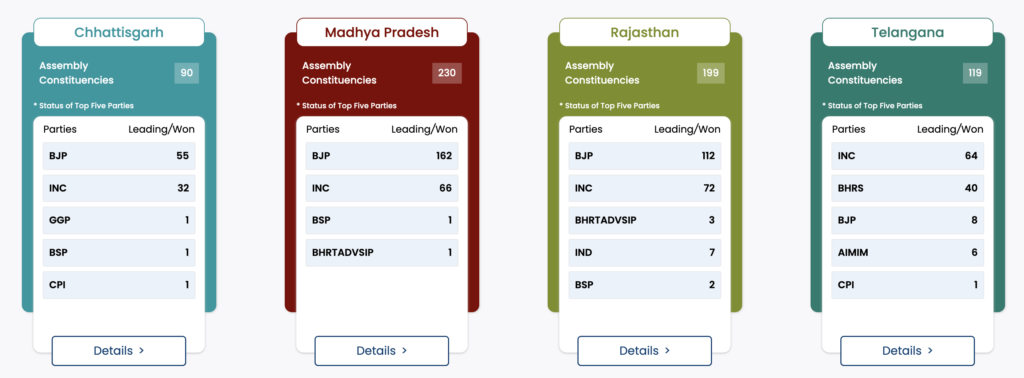

Hey there, folks! Today, we’re diving into some exciting news. The BJP, known for its right-wing, pro-business policies, just scored big in the state elections. They’ve won in three out of four states, and in Telangana, they’ve really upped their game, doubling their vote share. This could mean they might get about 10 seats out of 119 – a significant jump from before.

Now, if you’re wondering what this has to do with the stock market, you’re in for an interesting ride. Let’s break it down in simple terms.

1. The Modi Magic in Madhya Pradesh

First off, Prime Minister Modi has been a key player for the BJP. His influence helped them make history in Madhya Pradesh. It’s a big win for the party, and a lot of people think it’s thanks to Modi’s leadership.

2. A Clean Sweep in the Hindi Belt

The BJP didn’t just win in one place. They swept through the Hindi-speaking states, taking three out of three. This was a surprise to many, especially since the exit polls didn’t predict such a strong performance.

3. A United Front

What’s interesting is who voted for the BJP. Tribals, women, and the OBC community showed their support, rejecting the divisive caste politics that were expected to play a big role.

4. Gaining Ground in Telangana

Even in Telangana, where they didn’t win, the BJP’s making noticeable progress. They’ve got 13.8% of the vote, which is a big deal for them in this region.

5. Looking Ahead to 2024

All this success puts the BJP in a great position for the 2024 national elections. They’re looking strong and ready to lead.

So, What Does This Mean for the Stock Market?

Great question! Historically, when the BJP wins, it’s good news for the stock market. Investors like stability and pro-business policies, both of which the BJP is known for.

Monday’s Market: Up, Up, and Away?

There’s a buzz that Monday’s market might see a big jump. We’re talking about a potential rally in the Nifty index of maybe 1500 to 2000 points. That’s huge! This could be a Super Sunday effect rolling into Monday, with investors feeling super confident about the BJP’s win.

Quality Is Key

If you’re thinking of jumping into the investing pool, remember this: go for quality. The smart move is to invest in solid, well-established companies. They tend to perform well and offer good returns over time.

Uncertainty, Be Gone!

The stock market doesn’t like surprises, but it loves predictability. With the BJP’s win, there’s a sense of certainty about the political future. This could bring in more Foreign Institutional Investors (FIIs), who are always on the lookout for stable markets to invest in. If you haven’t invested in the Indian markets yet, now might be a good time to start.

The Big Picture

In a nutshell, the BJP’s victory in three states is fantastic news for the stock market. It sets a positive tone and could lead to some big gains. So, if you’re an investor or thinking of becoming one, keep an eye on the market. Things are looking up!

Happy investing, everyone, and let’s see what exciting developments this week brings us in the world of stocks and shares! 📈🎉

Keep following us on TradeAlone for more such insights.

Uncategorized

IREDA partners with PNB for Power Renewable Energy Projects, stock trades down

New Delhi, February 19, 2024 – The Indian Renewable Energy Development Agency Ltd. (IREDA) and Punjab National Bank (PNB) have formed a strategic alliance, signing a Memorandum of Understanding (MoU) to boost renewable energy initiatives across India. This collaboration aims to co-finance and syndicate loans for diverse renewable energy projects, marking a significant step towards achieving sustainable energy goals. Despite this the stock trades negative in the early session.

Strengthening Renewable Energy Financing

In a significant move at IREDA’s New Delhi office, Dr. R. C. Sharma, IREDA’s General Manager, and Shri Rajeeva, PNB’s Chief General Manager, inked the MoU. This event, witnessed by Shri Pradip Kumar Das, IREDA’s CMD, and Shri Atul Kumar Goel, PNB’s MD & CEO, along with senior officials from both entities, sets the stage for a transformative partnership in renewable energy financing.

A United Front for Green Energy

“This strategic partnership between IREDA and PNB represents a major leap in our mission to accelerate renewable energy growth in India,” stated Shri Pradip Kumar Das, CMD of IREDA. By leveraging their combined strengths, IREDA and PNB are committed to offering substantial financial backing to renewable energy projects, thus supporting sustainability and environmental conservation. This initiative aligns perfectly with the Hon’ble Prime Minister’s COP26 announcement to achieve a 500 GW Non-Fossil-based electricity generation capacity by 2030.

Broadening Support for Renewable Projects

The MoU includes provisions for joint lending, loan syndication, and underwriting, as well as managing Trust and Retention Account (TRA) for IREDA borrowers. It also facilitates investments in bonds issued by either organization, ensuring competitive terms of sanction and pricing for IREDA borrowings.

Building a Coalition for Clean Energy

IREDA’s collaboration with PNB enhances its portfolio of partnerships with premier financial institutions aimed at co-lending and loan syndication for renewable energy projects across India. Moreover, these strategic alliances underscore the collective drive towards meeting India’s renewable energy aspirations.

Recent development for IREDA

Bhubaneswar, February 11 – IREDA takes a groundbreaking step by partnering with the Indian Institute of Technology, Bhubaneswar, to foster innovation and research in the renewable energy sector. Signed at the 100 Cube Start-up Conclave at IIT Bhubaneswar, this MoU aims to support collaborative innovation, technology transfer, and the nurturing of the start-up ecosystem in renewable energy.

Pioneering Renewable Energy Research

Shri Pradip Kumar Das, CMD of IREDA, and Dr. Debi Prasad Dogra, Independent Director of IIT Bhubaneswar, sealed the partnership in the presence of Shri Dharmendra Pradhan, the Hon’ble Union Minister, and Prof. Shreepad Karmalkar, Director of IIT Bhubaneswar. “Our partnership with IIT Bhubaneswar marks a pivotal milestone in promoting sustainable development and innovation within the renewable energy sector,” said Shri Pradip Kumar Das.

Advancing Clean Energy Development

The collaboration promises to jumpstart joint research initiatives, facilitate technology transfers, and offer comprehensive support to start-ups in clean energy. It also includes capacity-building efforts such as training programs and workshops to bolster IREDA officials’ expertise in renewable energy.

Why IREDA share is going up?

Litsed just a month ago, shares of IREDA have more than doubled in the PSU rally. This increase in stock price is primarily because of the PSU stock growth we witnessed in the early half of Febuary. Moreover, we feel the stock was undervalued at a listing price. Despite the recent up stock currently trades at a PE of 35, this is fairly valued as per the valuations of the competitors. Investors must explore into balance sheet of companies before making a buy or sell decision.

Embracing a Sustainable Future

These partnerships signal IREDA’s commitment to advancing India’s renewable energy capabilities. Through strategic collaborations and fostering innovation, IREDA aims to pave the way for a sustainable and energy-secure future, aligning with national and global clean energy targets. Read more on renewable energy and Tata Power below.

Also follow us on Tradealone for more such timely updates on your favourite stocks.

Uncategorized

Manorama Industries Limited Takes New Steps in Stock Split and Business Growth

Key Developments at Manorama Industries

Raipur, January 15th, 2024 – Manorama Industries Limited, a front-runner in specialty fats, butters, and exotic products, is hitting the headlines with two major announcements that could reshape its market presence and shareholder value.

1:5 Stock Split: Making Shares More Accessible

The Board of Directors has given the green light to a stock split, changing the face value of its shares from INR 10 to INR 2. What does this mean for investors? Simply put, it’s going to make the company’s shares more affordable and increase their liquidity in the market. A smart move that could attract more investors!

Geographic Expansion and Product Diversification

The company isn’t just stopping at a stock split. They’re setting their sights on bigger, global goals. Manorama plans to strengthen its roots in key international markets by setting up entities in the UAE, Russia, and other strategic locations. This expansion aims to bolster their business operations significantly.

Chocolate & Confectionery: The New Frontier

But there’s more brewing at Manorama. They’re eyeing the lucrative Chocolate & Confectionery sector. Think real chocolate, super compound slabs, compound chocolate, and specialty cocoa products. It’s a natural extension of their existing business line, tapping into both domestic and international markets.

Updates and Developments:

- New Fractionation Plant: The company is gearing up to complete its new fractionation plant’s CAPEX by FY24. This expansion is set to boost its production capacity, solidifying its position in the global market for CBE and specialty butter & fats.

- Credit Rating Upgrade: Manorama’s commitment to growth and excellence has been recognized with an upgraded credit rating by CARE, now standing at ‘CARE A-, Stable’.

- Investor Relations: Ernst & Young LLP has been roped in to manage their investor relations, signaling a step towards strengthening stakeholder communication.

- Manorama Industries share has jumped around 100% in the last 1 year, doubling from 1000 to 2000 rupees per share. It’d be interesting to see how the stock price reacts to this news.

Words from the President

Mr. Ashish Saraf, President of Manorama Industries, expresses confidence in these strategic moves. The stock split, geographic expansion, and foray into new product lines are not just about growth but also about enhancing shareholder value and meeting global demands.

About Manorama Industries Limited (MIL)

Since 2005, MIL has been a leader in the manufacturing of specialty fats & butters. With a focus on R&D and quality, MIL offers customized solutions to top global companies. Their commitment to ESG practices underscores their dedication to sustainable and responsible growth.

Uncategorized

EaseMy Trip jumps into the Insurance Sector with a New Subsidiary

EaseMy Trip popularly known for for its travel services, just stepped into the insurance world with the launch of its new arm, EaseMyTrip Insurance Broker Private Limited. This move aims to expand their services and cater to the insurance market’s growing needs. By venturing into insurance, the company plans to leverage its customer base of 20 million users.

EaseMy Trip is looking at Opportunities in the Insurance Market

India’s insurance sector is on the rise, with annual growth rates of 32-34%. By 2027, experts believe that the sector can reach a milestone of US$200 billion. EaseMy Trip sees this as an opportunity to expand its offerings and expand its business horizons.

Pioneering Change in the Industry

The incorporation of EaseMyTrip Insurance Broker Private Limited as a distinct entity under the parent brand signifies the company’s dedication to innovation. Mr. Nishant Pitti, a driving force behind the company, takes the helm as the Director, ushering in a new era for the company.

CEO’s Enthusiasm and Vision

Mr. Nishant Pitti, CEO and Co-Founder of EaseMyTrip, is excited about this leap into the insurance domain. He aims to elevate their customer offerings by providing a comprehensive travel ecosystem that now includes insurance solutions.

A Vision for Innovation

EaseMyTrip Insurance Broker Private Limited is set to redefine the insurance sector. Fueled by innovation and a customer-centric approach, the company aims to meet customers’ evolving needs effectively.

A Glimpse into EaseMyTrip

EaseMyTrip, a prominent online travel platform listed on NSE and BSE, has been flourishing at a remarkable rate. Offering end-to-end travel solutions with no booking fees, it provides access to a vast network of airlines, hotels, and transportation services. Read more Finance news with Tradealone.

-

Profit Making Idea1 year ago

Profit Making Idea1 year agoThe Grandfather Son (GFS) Strategy: A Technical Analysis Trading Strategy

-

Technology5 months ago

Technology5 months agoInnovative Metro Ticketing Revolution in Pune by Route Mobile and Billeasy’s RCS Messaging. Stock trades flat

-

editor9 months ago

editor9 months agoHow to research for Multibagger Stocks

-

Trending12 months ago

Trending12 months agoDoes the “Tata-Apple venture” benefit Tata shares?

-

Finance World12 months ago

Finance World12 months agoHow Zomato Turned Profitable: A Landmark Achievement in the Indian Food Delivery Market

-

Market ABC8 months ago

Market ABC8 months agoSpotting an operator game: How to do it?

-

Market ABC1 year ago

Market ABC1 year agoThe Pullback Strategy: A Timeless Approach to Investment Success

-

Finance World10 months ago

Finance World10 months agoDmart VS Walmart – Business Model of Retail Giants

Pingback: tadalafil or sildenafil

Pingback: sildenafil 50 mg tablet buy online

Pingback: tadalafil otc

Pingback: cost of sildenafil in india