editor

Financial goal planning

Money management

India is the most populous country in the world comprising of one sixth of worlds population. When we segregate the total population by age, 25.68% comprises of people between 0-14 years, 67.49% comprises of people between 15-64 years while 6.83% comprise 65 + people. While the earning category occupies 67.49% of total population, has this major crowd be able to invest their earnings properly to gain returns?

The per capita income, which indicates the income earned by an individual in a year, denotes the financial health of a country. Though the per capita income does not consider the unevenness of the wealth distribution, it can give a clearer picture of the country’s overall wealth. Such population needs the knowledge of financial goal planning.

There has been a 35% increase in per capita in these years. But has this increased money circulation in the economy been beneficial for the individuals of the country? What are the better options to benefit from investing wisely?

Let us find out answers.

What is financial planning?

Financial planning is a way of planning finances to manage money in a better way. The term financial planning includes so much details into it. If you are a first-time investor, financial planning starts with understanding your current position in terms of finances, where to invest money, how much savings it takes to reach the financial goals and the techniques to reach there.

The financial planning includes different stages to be executed to reach the goal and become a better investor.

What are financial objectives?

Financial objectives are goals that an individual or company aims to achieve, to divert the funds it has earned to grow its profits, increase cash flows, and gain return on invested capital.

The financial objectives can be classified on basis of the time it takes to attain them into 3 categories,

• SHORT TERM GOALS– Can be reached in less than a year, are easy to achieve, focuses on current issues.

• INTERMEDIATE GOALS- Can take 1 to 5 years to reach, possess traits of both short term & long-term goals.

• LONG TERM GOALS- Can take more than 5 years, they focus on retirement and requires periodic evaluation.

Common mistakes made in financial planning

STARTING LATE ON FINANCIAL PLANNING

One mistake that we always regret is, why didn’t we start early? Where did all the money go before starting to save?

It is better to start process of financial planning earlier when we start earning income. Time plays an important role in financial planning. When we start planning earlier, we will have more time in creating and nurturing income earning assets and investments. Power of compounding plays an important role in favoring who saves for longest period. people start investing after 30’s but lose a decade to end up in less savings when they turn 50.

INVESTING IN STOCKS WITHOUT RESEARCH

Investing in stock market is one of the easiest way of investments. But if research is not done properly all the capital is lost in short time. People lose money if they buy stocks based on social media tips, buying penny stocks, investing without knowing fundamentals, buying stocks based on dividends without knowing the ethical nature of the company.

OVERESTIMATING THE RETURNS OF INVESTMENT

Return on investment is a way of calculating how much an investment has earned by comparing it with other investment techniques or average return of investment in a country.

While there are various ways of investments like Mutual funds, public provident funds, government bonds, Gold, real-estate, we may sometimes fail to estimate the right value of return.

While FD in banks gives a return in the range of 4% to 8%, the equities can give higher returns with higher risk appetite also. It takes proper research and planning to find the right investment segment.

FOCUSING MORE ON INSURANCE POLICIES

Now a days more investors try to save tax under section 24, which is flat 30% deduction on net value of rented property, in case the property is bought using the owner’s own money. Focusing too much on insurances and other policies to get exempted from tax will take the focus away from financial planning and distract ourselves from long term financial goals.

Basics of financial planning

The picture shows various parts of basics of financial planning, let us discuss each in detail:

CONSTANT MONITORING OF PLANS AND EXPENDITURE

With changing geo political situations, government policies, interest rate changes, constant monitoring of financial objectives are necessary. And customizing the plans accordingly will help investor from undergoing losses. While more focus is given on savings and investment alone, expenditure part is untouched. Borrowing so much from banks, increasing credit card bills and EMI’s can lead to failure in attaining one’s financial goals.

CALCULATING NET WORTH

Knowing our own net worth helps to understand our financial health. In general terms net worth of an individual is deducting liabilities from his/her assets. While the assets include

• Savings account balances

• Investment in securities

• Real estate properties

• Possession of auto mobiles.

The liabilities include

• Credit card balances

• Student loans

• Car loans

• EMI’s

The importance of knowing the net worth will help understand true value of an individual and help in financial planning by trying to increase the assets if they are less compared to liabilities.

UNDERSTANDING CASH FLOW

To arrive at the cash flow of an individual it is necessary to gather all the information regarding the income and expenses. While people are happy when the monthly salary is credited but end up spending all the money in the beginning of the month to wonder where did all the money go?

To concentrate on financial planning, on needs to understand the pattern of their cash flow. For which its necessary to make a cash inflow statement and cash outflow statement and subtract both.

If the result is positive then we have extra money to make investments, other wise its high time to control the expenses by spending smartly.

UNDERSTANDING RISK

Every investment has risks associated with it. Every investment and savings have different risks and returns. Risks associated with investment can include

• Business risk – the company we invest must have stability in the business, even if the company goes bankrupt it should be able to pay the bond holders and stock holders. It is wise to chose a financially stable source to invest

• Volatility risk- All investments are bound to economic changes externally and threats internally. So, volatility plays an important role while choosing investment sources.

• Inflation and interest risk- Inflation which is upward movements of prices reduces purchasing power of buyers and in turn affecting fixed interest rate received by investors. The interest rate risk affects the bonds if they are having less interest rates compared to the newly issued bonds having attractive interest rates. So, it creates a risk of reduced interest for investors having older bonds.

CREATING EMERGENCY FUND

Emergency funds are funds that are set aside to cater sudden unplanned expense or financial emergencies. It is important to have an emergency fund because, some sudden financial distress will set us back and that same distress will turn into debt that is difficult to recover from. By managing cash flow and creating a proper savings routine will help one build an emergency fund.

Investment options, Risks and returns

Let us discuss the risk & return associated with each investment options:

How to reach the financial objectives?

Start from Planning for retirement, though it comes last as we age, it is of top most priority. It is so important because we are devoid of income once we retire. And depending on children after retirement is not a good option.

Retirement analysis

The retirement analysis consists of the following steps.

- Describing retirement goals such as what age we chose to retire, investment options and return, risk associated with it is the initial stage of analysis.

- Outlining savings and spending estimates such as current annual income, present savings for retirement, plans for savings, and social security income guarantee, money planned to spend in retirement.

- After assessment of the above details, final stage is figuring out a plan for retirement.

Saving for children

Saving for children is so much important as a corpus can protect them from any financial disasters in case of emergencies. Right way of planning is important to help children in good quality of education and giving them a solid foundation to boost their confidence with financial backup. The ways we can save for children are

• Term insurance plans

• Savings plans

• SIP (systematic investment plans)

• Sukanya Samriddhi yojana

• Debt funds

• Investments in gold

• National savings certificate in post office.

We can now see the most helpful money practices that anyone can follow in their lives

FINANCIAL PLANNING FOR SOMEONE IN 20’S

20’s is the age for someone who has just completed their education or just started with PG or higher education. The benefits of investing early are

• If investment starts in age of 20, there is chance of attaining a huge corpus fund by age of retirement.

• Investing for a longer period in regular intervals consistently averages out the risk factor.

From the chart we can see, if we start investing early say 2005 and invested at regular intervals, the stock would have given a huge return in 2023.

• High returns of investment on account of compounding.

We can see the power of compounding from the above table.

FINANCIAL PLANNING FOR SOMEONE IN 30’S

30’s is the age when the career has started to be stable with stable income. The earning capacity is at peak and family choices regarding children, house is carried out in this period.

What financial planning can be done in 30’s to save better?

• Considering savings but cutting unnecessary expenses can be helpful. While this is the right time to have stricter spending rules because, earning and spending starts at 20’s and it should have reached a maturity in 30’s

• Invest in mutual funds with large cap stocks, or even Multicap stocks to reduce risk and better returns.

• Ensure better life insurance policies and include the family in health plans.

• While after college we start working in corporate jobs, it is necessary to have second career for additional income and to reduce job uncertainty in the competitive world.

FINANCIAL PLANNING FOR SOMEONE IN 40’S

40’s is the age when we have crossed half of the physical health or ¾ th of the career is covered. The peak of the career which is already over, increments or career growth is very gradual after 40’s.

• It is important to pause, take a step back and realize how much assets we have earned over last 2 decades and what will be the plan for next 2 decades.

• Focusing on retirement corpus is so much important. Let us see a table to figure out how much it’s important to plan properly.

Considering there is inflation of 6% throughout life

The monthly expense is not the same and increases with increasing inflation.

• Investing in children education policy

There are so many plans for children’s education cover:

An investment tenure of 15 years with SIP of Rs.8400 and annual average return of 12% can give a Corpus fund of 41,80,000 after the maturity.

• Expenditure planning and avoiding debt currently are crucial part of financial planning.

Make the money work for you!

Hope this article pretty much covered all the parts of financial planning. We walked through the types of financial planning objectives, common mistakes done while planning, the basics of financial planning, various investment options available, their risk and return appetite and the way to reach the financial objectives. At the end of the discussion, we discussed how financial planning is necessary in every stage of life to develop good money habits. Let us all ensure to invest smartly, so that money will do the work for you, while you relax.

To know more about long term investment visit https://tradealone.com/is-long-term-investment-worth-it/.

editor

Can I become rich by Trading in the stock market? Do people become rich by Trading?

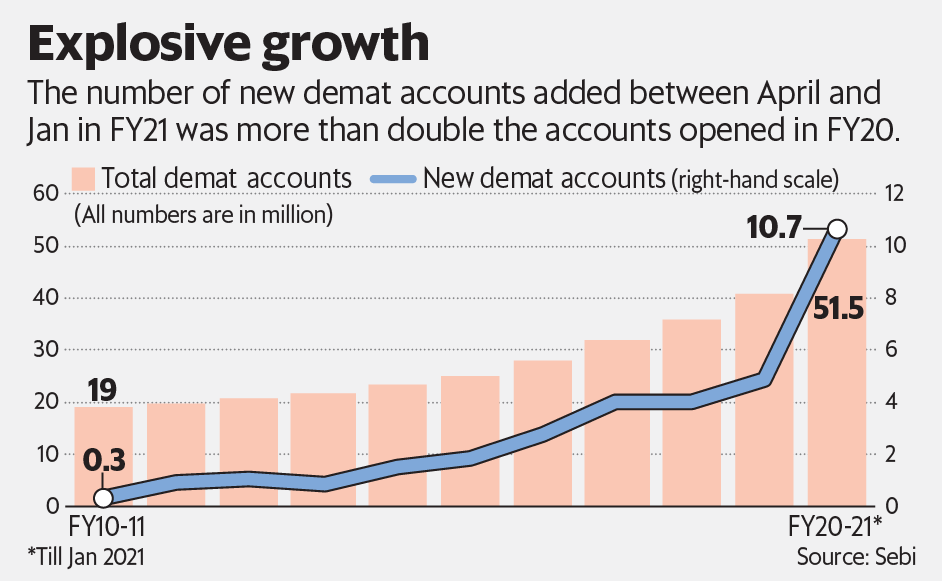

No matter your job, take a moment to observe your colleagues in the office, and you’ll likely find that nearly everyone is involved in the stock market trading these days. The younger crowd might be exploring cryptocurrencies. However, for those earning a regular salary, the stock market seems to be the go-to investment choice. Why is it gaining such traction? One word: profitability. Despite the ongoing fear of recession and the economic challenges post-COVID, the stock market hasn’t faced any significant downturns recently. This is largely because of a surge in the retail investors pouring their funds into the market. Expect this trend to stick around for at least the next five years. This makes the stock market a promising option for investors looking to get rich. Below is a chart on the explosive growth of Dmat accounts in India.

Finally, jumping into the question of whether trading can lead to wealth, the answer isn’t straightforward. While it’s true that numerous individuals have gathered wealth through trading, the majority have found success through long-term investments. However, trading does have the potential to significantly increase your wealth, provided you’re ready to dive deep into the details of stock price movements, have a bit of luck, and operate within a favorable market environment. Essentially, achieving wealth through trading requires being in the right stock at the right time during a market upswing, coupled with adequate capital and a solid understanding of both technical and fundamental market analysis. In this article, we’ll further explore the pathways to becoming wealthy through trading.

What is Trading?

Trading in the stock market involves engaging with a stock for a brief period. Essentially, it means purchasing a stock and selling it soon after for a profit, aiming to buy and sell quickly once a specific profit margin is achieved. Contrarily, investing is about buying stocks with the intention of holding onto them for long-term gains. Trading can be categorized into intraday trading or swing trading, each with its unique approach.

- Intraday Trading: This involves buying and selling stocks on the same day. The advantage here is the ability to buy up to five times the shares with the same amount of capital thanks to a 20% margin. However, the catch is the necessity to sell your shares by the day’s end, even at a loss, making it a speculative and high-risk endeavor.

- Swing Trading: This strategy is akin to investing but over a shorter timeframe, such as a week, a month, or a few months. The goal here is to sell the stock once a predetermined profit target is reached and then move on to another stock. Unlike intraday trading, swing trading does not compel you to sell if the stock’s value decreases after purchase.

In summary, both trading strategies aim for profit but differ significantly in their approach and risk levels.

How can I become rich by trading?

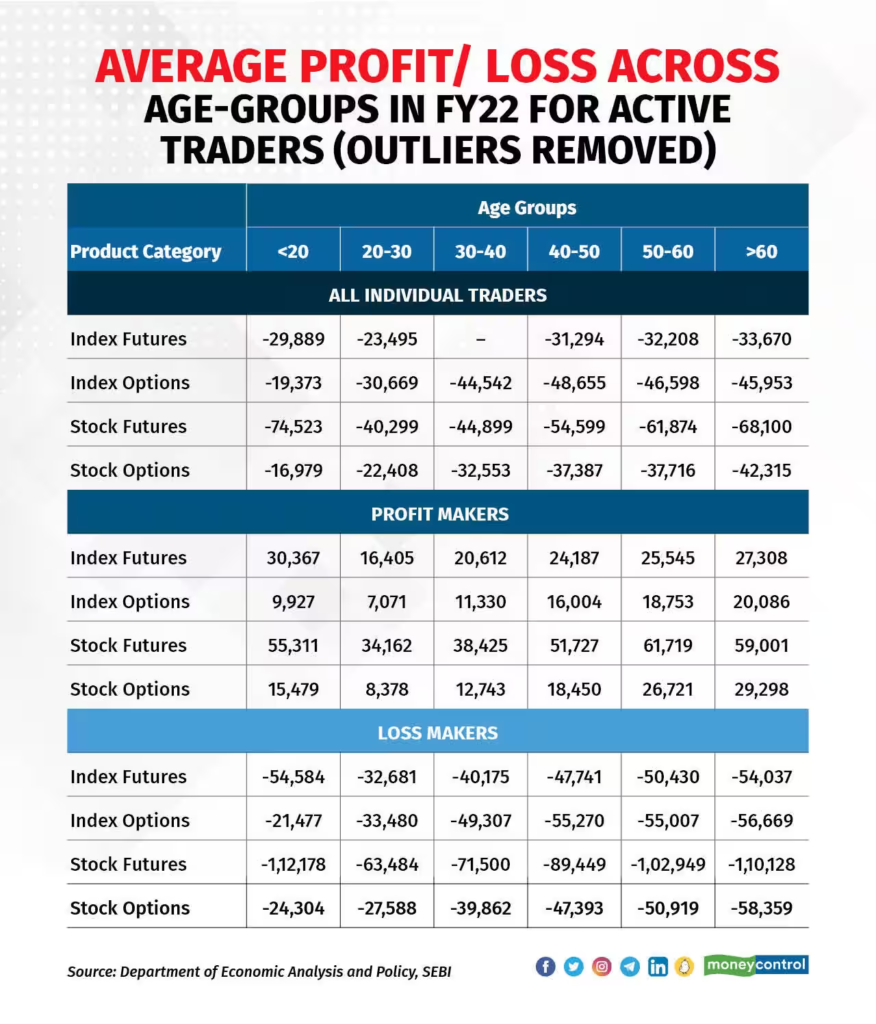

Becoming wealthy through trading isn’t as straightforward as it might seem. In India, a massive 90% of intraday traders conclude the year with losses. This stark statistic highlights the necessity of being among the elite 10% of traders just to secure a profit, let alone accumulate wealth. This means to get rich by trading, aiming for the top 2-3% of intraday traders is essential. Achieving this level of success requires rigorous study and a careful approach to avoiding common trading mistakes. Our goal here is to paint a realistic picture of the challenges involved in profiting from the stock market. However, stick with us as we explore strategies to join the ranks of the top 2% of traders. Meanwhile, lets take a look at the data for active traders in India.

Factors to consider to become a successful Trader

Despite extensive learning from books and YouTube videos, losses in the stock market are still possible because trading requires attentiveness to various factors, much like driving. To assist, we’ve compiled a list of essential factors to consider, ensuring a more informed trading approach.

- Focus on learning the fundamentals: Understanding the distinction between profitable and loss-making traders is crucial, and it often comes down to one key factor: learning how to trade effectively. Luck might bring success once or twice, but for consistent positive outcomes, acquiring trading knowledge is essential. To delve deeper into the fundamentals of trading and enhance your skills, consider our free and paid courses.

- Keep realistic expectations: Doubling your money weekly is unrealistic without time travel. My personal best was a 20% gain in a month during a significant bull run, using both swing and intraday trading. Typically, you might aim for a maximum of 5% monthly. However, in adverse conditions or a bear market, achieving any profit can be challenging, and losses are possible. So, it is essential that you maintain realistic expectations from the stock market. It is not a money making machine that can make you rich in a few months.

- Start as early as possible: Achieving wealth is a personal goal; for example, earning 1 crore might be one’s definition of being rich. To accumulate such wealth from the stock market requires either substantial initial capital or a long-term commitment. Starting in your early twenties could be advantageous for those aiming to build significant wealth through trading. I personally started at the age of 24 and I have made a lot of money in my journey of 3 years. So, I have plenty of time to compound my earnings now.

- Trade only on opportunity: Achieving consistent profits in trading relies on capturing the right opportunities rather than engaging in unnecessary trading, which often leads to losses. It’s crucial not to feel compelled to trade daily. If the trading conditions you rely on aren’t present on a particular day, it’s wise to step back. Patience and strategic action based on well-defined opportunities are key to success in the trading world.

- Take risks when theres a chance: There will be oppertunities where you’d be sure of your trade, in those instances you could play with more amount of money. for example you have 100 Rupees and usually you trade in 5 stocks with 20 rupees each. but on certain day you see a very high probability of a share to go up by 5%, in those situations you may have to play a single trade with 100 Rupees to get the most out of the trade.

- Don’t get obsessed about a single stock: It may happen that a stock which you expect to go up by 10% is now stuck in a small range and is showing unpredicatble price movement. In those situations, you dont have to be obsessed about that stock and regardless of the bad situations end up trading on that. every stock presents an equal opertunity, dont generate affection with a particular stock.

- Try to trade in the momentum: Mornings are where most of the movement is seen in stocks based on the news. so, make the most of this and try to enter in the morning hours, preferably after the opening hours. this helps because theres a lot of volume action in the morning time. where theres volume means more possibility of stock price to move in a higher range. read our volume analysis report here.

Even if you follow all the above rules, you might still find yourself in difficult situations due to the dynamic nature of the stock market. We have covered a few of these situations below. The most important thing here is consistent learning and elevated self-confidence. Remember, don’t become obsessed with the stock market; it won’t change your life overnight.

What if I lose most of my money?

Trading can result in significant losses. If you find yourself making consecutive incorrect trades, it’s advisable to pause and reflect on the causes of these setbacks. Assess whether it was a poor choice of company or overlooked critical factors in stock selection. Every trade offers a learning opportunity, so maintain a notebook to note down mistakes after each unsuccessful trade. This practice helps in identifying patterns in errors and refining future trading strategies.

What should be my capital?

We recommend starting with 20,000 rupees to see if trading suits you. It’s crucial to assess whether you can manage the stress of daily gains and losses. While taking inspiration from others and YouTube channels is beneficial, you should avoid making trades solely based on someone else’s advice. There’s a temptation to increase your capital after a few successful trades, but don’t let it dominate your decision-making. Often, traders start losing money as soon as they invest more.

How much can I expect?

Don’t expect the market to make you ultra-rich in a short period. It’s best to enjoy your job and aim to improve your earnings and learning. Trading can provide additional funds for spending or reinvesting, but it should not be relied upon for daily living. Keep your expectations realistic. You might aim for 30-40% profits annually if you become very skilled. Remember, many stocks could potentially grow 30-40% within a year without causing you stress.

Where to learn about trading?

There are many books available on Amazon that you can refer to. “Trade Like a Stock Market Wizard” is my top pick. This book is for swing traders and not intraday traders. I personally feel swing trading offers more potential if you have a large capital. But, if you are new to the stock market, intraday trading with a small capital can give you much more learning and lessons. You can follow multiple Telegram or YouTube channels as well. However, be cautious as many of these influencers are turning out to be frauds.

Thus, is it very difficult to become rich by trading in the stock market. However, its not very difficult to accumulate wealth by trading on the favourable instances.

editor

Understanding the Paytm Scenario: A Guide for Investors

Paytm is a loss making machine from the day it got listed on the NSE index. The recent weeks have been the most painful. The company faced a series of regulatory setbacks, stock price fluctuations, and operational changes, which have left investors and market observers scratching their heads. Let’s break down what happened to Paytm and explore what investors should consider doing next.

Key Events Impacting the Paytm stock

- RBI’s Directive: Starting February, the Reserve Bank of India (RBI) put a stop to Paytm Payments Bank’s new deposits and wallet transactions. This move was a significant blow to Paytm’s operations.

- Stock Price Tumbles: Following a report from Macquarie that lowered Paytm’s target price to Rs 275 and downgraded its rating to “Underperform,” Paytm’s stock price fell by 8.5%. The stock hit an all-time low of Rs 386.25, indicating a notable loss of confidence among investors.

- Regulatory Challenges: Paytm’s regulatory hurdles, especially the RBI’s restrictions, have raised alarms, contributing to the stock trading at an 81% discount from its IPO price.

Paytm Stock Price since the listing day – A continues decline.

Before we proceed, it’s important to bear in mind that a company facing profit challenges in a competitive industry is likely to encounter difficulties. As informed and savvy investors, we must maintain our stock selection filters and not rush into purchasing such stocks during minor recoveries. Keep in mind, a stock’s price doesn’t rise or fall in a single movement; it fluctuates, but the overall trend is what truly matters. Therefore, if you’re not already invested and are tempted to buy in at these low prices, exercise caution.

Ok, now back to the events that unfolded for Paytm over this month.

February’s Rollercoaster Ride for the Paytm stock

- February 1: Reserve Bank of India (RBI) ordered Paytm Payments Bank to halt the acquisition of fresh deposits into its accounts or wallets effective February 29. This decision sent shockwaves through the market, leading to an 8.5% drop in Paytm’s stock price. Then leading investment firms started to cut the target price of Paytm.

- February 2: Paytm’s stock opened at a 20% lower circuit, anticipating a significant EBITDA impact.

- February 3: Morgan Stanley Asia Singapore Pte bought 50,00,000 shares of Paytm, signaling some investor confidence. But, this probably will turn out to be a bad decision!

- February 4: BSE adjusted Paytm’s daily stock limit to 10% after two consecutive days of hitting a 20% lower circuit. The stock was in an uncontrolled fall for a couple of days.

- February 5: Jio Financial Services’ shares surged due to false news about acquiring Paytm’s wallet business. General public was anticipating that either Tata or Ambani will acquire Paytm business.

- Mid-February Developments: Paytm faced further challenges, including being removed from the list of authorized banks for FASTag services by NHAI. However, the RBI confirmed Paytm’s operational functionalities would continue beyond March 15, 2024, after shifting nodal accounts to Axis Bank. The Enforcement Directorate also found no FEMA violations by Paytm Payments Bank Limited.

Investor Takeaways

- Regulatory Compliance: It’s crucial for businesses to stay aligned with local regulations. Compliance should be seen as an essential part of operations, not a burden.

Quote from a investor sitting on a heavy loss in Paytm share – “I am sitting in the loss of a few lakhs as I trusted Paytm and purchased the stock. Can you convince your investors how are you going to fill that loss and what are your future plans?”

Another retail investor tried to warn general public to not catch the falling knife. He said – “Never buy any stock making hype in media/social media for any reason,+ve or -ve. You will save yourself from alot of blunders! For example, think about the people who bought paytm on first reversal. while they know everything still they are trapped.”

- Funding and Market Entry: Companies need to be mindful about their sources of funding and how they expand, especially in politically sensitive times.

- Focus is Key: Diversifying is good, but not at the cost of losing sight of the core business. Companies must ensure their primary operations are solid and compliant. Investors must have a long term view and not shuffle their portfolio unless there is a need to do so. We are sure that many retail investors must have sold their profit making shares and purchased Paytm at a 20% correction anticipating some gains. But, remember that once you are trapped in a loss making company, you could remain trapped forever.

- Caution for Investors: Given Paytm’s current situation, with significant stock price volatility and regulatory challenges, investors should proceed with caution. It’s advisable to consult with a financial advisor, especially if you’re already invested.

Read more about the fundamental analysis of Paytm below. Can Paytm turn Profitable?

Why Paytm share hit an upper circuit?

This is where things get exciting, Paytm has hit a 5% upper circuit for a couple of consecutive days now. Axis Bank helped Paytm this time as Paytm partnered with Axis Bank for the settlement of merchant payments. Paytm has shifted its nodal account to Axis Bank through an escrow account that it has opened with it. But remember, stock price will eventually is decided by company performance and balance sheet. These upper circuits are news driven, as of now we are not sure what kind of impact will this have on the functionality of Paytm.

Moving Forward

Paytm’s recent experiences underscore the complex landscape of financial technology in India. For investors, these developments are a reminder of the importance of diligence and cautious optimism when dealing with stocks facing regulatory and operational hurdles.

For those invested in or considering an investment in Paytm, staying informed and seeking professional advice is key. The path ahead for Paytm is fraught with challenges, but with careful navigation, there may still be opportunities for growth and recovery. Keep following Tradealone for more such informative content.

What are your thoughts on the Paytm situation? Do you believe the company will overcome these challenges? Share your views in the comments below.

editor

Navigating the Real Estate Market in India: A Perspective

In the dynamic landscape of Indian real estate, it’s crucial to see the market for what it truly is. Unlike in many Western countries, where populations are declining, India’s demographic trajectory paints a different picture. Let’s dive into the nuances of the Indian real estate market, shedding light on who wins, who loses, and how to navigate these waters.

Population Growth and Housing Demand

India’s population is not on the decline; predictions suggest it will peak around 2065. This demographic trend ensures that housing demand will remain robust for the foreseeable future. Unlike transient market trends, the basic need for housing, driven by a growing population, is a fundamental force that will sustain demand.

The Buying Behavior of the Rich

In India, real estate often finds favor with the affluent as a diversification strategy or a means to save on taxes. This segment of buyers is not just looking for any real estate; they’re in the market for ‘good’ real estate at fair prices. Their continued investment underlines a belief in the market’s growth potential. The narrative here is not just about investment but about strategic acquisition based on value, not just price.

The Middle-Class Quandary

The real estate dream, however, turns a bit complex for the middle class. Many find themselves navigating overpriced “boxes in the sky” in cities like Gurgaon or Noida. The crux of the issue lies in transparency—or the lack thereof. With an almost infinite supply from well-connected builders and no clear insight into fair pricing, the middle class often ends up buying at inflated prices. This experience has led many to view real estate as a dubious investment, though this isn’t the whole story.

Builders and Bankruptcy

It’s worth noting that builders do face financial hurdles, often not due to the value of the real estate itself but due to liquidity management issues. Rapid acquisition without proportional sales leads to cash flow problems, not necessarily losses on the property’s value. This distinction is crucial in understanding the market’s dynamics.

Buying Smart: The Key to Real Estate Investment

The mantra for success in real estate, much like in stocks, is buying at fair prices. In India, the trick is to look for properties with limited supply and unique characteristics in prime locations. This strategy not only shields one from the volatile swings of over-supplied markets but also ensures that the investment holds intrinsic value that appreciates over time.

The Bright Side of Indian Real Estate

India’s increasing population, coupled with a preference for nuclear families and the allure of real estate as a tax-saving vehicle, all contribute to a rising demand. Furthermore, India’s growing wealth and GDP bode well for the real estate market. However, potential investors should be mindful of liquidity—the capacity to endure periods when the money is tied up in property before it yields profit.

In conclusion, while the Indian real estate market presents vast opportunities, it also requires a nuanced understanding of its dynamics. For those looking to invest, the key lies in thorough research, patience, and a focus on properties that offer something truly unique. As the country’s economy grows and its population increases, the demand for quality real estate will continue to rise. Navigating this market with a strategic approach can unlock significant value for discerning investors. Check more investment related blogs here.

-

Profit Making Idea1 year ago

Profit Making Idea1 year agoThe Grandfather Son (GFS) Strategy: A Technical Analysis Trading Strategy

-

Uncategorized8 months ago

Uncategorized8 months agoA BJP victory and the Stock Market: what to expect this monday

-

Technology5 months ago

Technology5 months agoInnovative Metro Ticketing Revolution in Pune by Route Mobile and Billeasy’s RCS Messaging. Stock trades flat

-

editor9 months ago

editor9 months agoHow to research for Multibagger Stocks

-

Trending12 months ago

Trending12 months agoDoes the “Tata-Apple venture” benefit Tata shares?

-

Finance World12 months ago

Finance World12 months agoHow Zomato Turned Profitable: A Landmark Achievement in the Indian Food Delivery Market

-

Market ABC8 months ago

Market ABC8 months agoSpotting an operator game: How to do it?

-

Market ABC1 year ago

Market ABC1 year agoThe Pullback Strategy: A Timeless Approach to Investment Success

Pingback: Impact of Inflation on the Stock Market - Trade Alone