Market Basics

Intraday Trading Vs Swing Trading

In the trading world, traders take in use various techniques to profit from the constantly fluctuating markets. Intraday and Swing are two such techniques. Hello readers, hope the markets are blessing you with profits. In this segment, we will dive deeper into understanding the basic differences between Intraday and Swing trading and the benefits of each. So, buckle up!

Swing Trading

It is a trading technique which seeks to identify short- to medium-term price fluctuations within a broad trend. Swing traders can hold their positions ranging from days to weeks to sometimes several months. The timeframe of positions varies from trader to trader. By using this approach, they can profit from substantial price changes without being exposed to the volatility and noise of intraday trading.

Swing trading aims towards profiting from the big price movements which are usually observed during trends. For this, technical analysis is mostly used by traders. However, in some instances Fundamental analysis is also used to confirm the analysis.

Advantages

- Greater profits– Since traders aims towards profiting from major price movements, the profits are significantly more.

- Avoiding intraday noise– Swing trading allows traders to avoid the intraday noise and focus on the overall prevailing trend. This helps in improved analysis leading to better entry and exits.

- Less time commitment– For swing trading, traders do not need to sit in front of the screen all day. Since the time frame is larger, traders can check the status and updates of positions at their convenience.

Disadvantages

- Overnight Exposure– Since the swing positions are held overnight, this exposes traders to the risk of unexpected overnight changes. These changes if negative can lead to significant losses.

- Emotional management– A trader’s patience may be tested by holding positions for several days, and rash decisions based on emotion may result in early exits or clinging onto lost positions.

- Lost opportunities– Since swing traders focus on the big price movements, this leaves them lost from potential intraday movements. This can be due to various factors like, already open positions which could be in losses, shortage of trading capital if strict capital management rules are not applied and many more.

Intraday Trading

Intraday Trading is a common trading method, also known as Day Trading, in which traders open and close their positions within the same trading day. This saves traders from the overnight changes and events which can lead to significant losses.

Intraday trading aims at profiting from the daily price fluctuations of an asset without dedicating too much capital. For this technical analysis and various strategies are implemented, which helps traders to reduce risk and maximize returns.

To find trading opportunities, intraday traders examine a variety of elements including market trends, chart patterns, technical indicators, and news events. They focus on assets with significant trading volume and price volatility to produce potential returns, such as stocks, currencies, commodities, and indexes.

Advantages of Intraday

- Reduced Overnight risks– Since the positions are closed within the trading day, traders are not exposed to risks associated with overnight changes. Global news, company updates or gap openings can affect the price and might lead to losses.

- Quick profits– Traders can capitalize on the daily price fluctuations and make multiple, small trades with less risks.

- Capital friendly– Traders do not need to dedicate a significant portion of their capital since trades are closed within a day. This leads to them having more cash at hand for other potential opportunities.

Benefit of Margin

One more advantage Intraday provides is the facility of Margin. Currently as per the norms by SEBI, brokerages can provide traders a Margin up to 5x. This means that if any trader has a capital of Rs 100000, he/she can purchase or sell shares worth Rs 500000.

Before December 2020, this used to be higher than 5x. SEBI to prevent traders from misusing the margin trading facilities decided to limit the maximum limit. This was done for the benefit of retail market participants who had a limited amount of capital. New traders would misuse margin money and create trades with volatile and risky stocks, which would lead to even bigger losses.

For example, if a trader has a capital of Rs 10000, and wants to trade a stock worth Rs 500, a total of 20 shares can be bought with this capital. However, before limiting the margin to 5x, many brokerages would offer up to 40-50 times margin. That means if we consider a margin of 20x, the same trader can now purchase shares worth 10000*20= Rs 200000. This certainly would lead to an increase in profits, since the quantity increases 20 times, however the risk too increases significantly.

New traders often would end up wiping all their capital. To prevent this from happening, SEBI decided to fix the margin to 5x.

This decision received mixed reviews from traders. Some traders due to decreased margin, shifted to derivatives trading.

Disadvantages of Intraday

- Time commitment– Day traders must closely watch the markets, study charts, and act quickly to place deals. Fluctuations in price are very abrupt and to cut losses or capture opportunities, traders must be present and alert.

- Emotional regulation– Since traders need to dedicate a significant portion, intraday becomes emotionally challenging. Quick price change, precise and fast decision making is a must which can lead to stress and anxiety.

- Overtrading– Intraday very often leads to overtrading. Usually new traders to average previous losses end up creating impulsive trades without proper analysis. This leads to even greater losses. Strict risk management and proper analysis is therefore very important before taking any trade.

Trading Brokerage

Depending on the type, different brokerages offer different services and expertise. Based on those services, brokerages charge accordingly. Mainly, there are two types of brokerages, Full-time or Full-service brokerages and Discount brokerages.

Full-time brokerages–

Full-time brokerages offer multiple and personalized services to their clients. Apart from the buy and sell service, they offer research reports of stocks, portfolio management facility, investment and trading recommendation and other wide range of products. Some of the popular full-time brokerages in India are-

- ICICI Direct

- IIFL Securities

- HDFC Securities

- SBI Securities

- Motilal Oswal

Charges for Delivery and Intraday services vary from brokerage to brokerage but usually, charges vary from 0.10- 0.60 percent.

Discount brokerages–

Discount brokerages are those firms which follow a low-cost model by providing the basic necessary services. They provide a platform for trades with lower brokerage charges without focusing too much on other services. They might supply educational materials and research tools, but they often don’t offer individualized consulting services. Some of the popular discount brokers in India are-

- Zerodha

- Angel One

- Upstox

- Paytm Money

- Groww

Most of the discount charge zero on delivery trades. While for Intraday trades it is either a flat rate, usually Rs 20 per trade or 0.01-0.05 percent per trade or whichever is lower between the fixed and percentage charges.

To give you an idea, let us compare the charges of top Full-time brokerage and Discount brokerage (ranking based on number of clients).

| Brokerage | Equity delivery | Equity intraday | F&O – Futures | F&O – Options |

| Zerodha | Zero Brokerage | 0.03% or Rs. 20/executed order whichever is lower | 0.03% or Rs. 20/executed order whichever is lower | Flat Rs. 20 per executed order |

| ICICI Direct | 0.55% irrespective of turnover | Up to Rs 50,000- Rs 25 or 2.5% whichever is lower.

Exceeding Rs 50,000- 0.05% |

0.05% | Flat Rs 95 per contract lot |

Although Discount brokerage due to the charges may seem more attractive, they lack the client-centric facilities and services. Decision to choose a broker must be made based on requirements and facilities they provide instead of their charges.

Swing trading and intraday trading each present unique chances and difficulties for traders in the financial markets. The decision between swing trading and intraday trading ultimately comes down to personal preference, trading objectives, and available time commitment. To choose the method that best suits their needs, traders must carefully consider their risk tolerance, preferred trading style, and market conditions.

That is all for now, happy trading!

Finance World

Understanding Contingent Liabilities: Implications and Risks for Companies

Introduction

Due to the potential to significantly impact a company’s financial situation and outlook for the future, contingent liabilities are crucial in financial reporting. These liabilities are potential debts that could be owed due to past incidents but they are unsure whether they will come to pass due to upcoming circumstances. Because of their inherent uncertainty, companies must carefully evaluate how to recognize, assess, and disclose these commitments in their financial statements.

Understanding Contingent Liabilities

As prospective obligations depend on unforeseen future occurrences, contingent liabilities are crucial to financial reporting. The company defers the recording of these liabilities on the balance sheet as actual obligations until the occurrence of the triggering event is likely or inevitable.

Recognition and Measurement

To account for contingent liabilities, businesses follow accounting guidelines like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Two important requirements must be met for contingent liabilities to be recognized:

- Probability

The business assesses the chance that the unknown event will materialise. If the contingent obligation is probable, or more likely than not, it is recorded in the financial statements and properly stated.

- Measurability

This second criterion examines whether it is possible to calculate the contingent liability’s amount with accuracy. The corporation assesses the liability and makes a provision on the balance sheet to reflect its prospective effect on its financial situation if it can make a reasonable assessment.

Managing Contingent Liabilities

Companies must manage and reduce contingent liabilities in order to maintain their financial health and secure shareholder interests. The following are important tactics that businesses can use to proactively handle contingent liabilities:

- Risk Assessment

Regular and thorough risk assessments are essential for identifying potential risks and exposures that could result in these liabilities. Companies can create suitable risk mitigation plans by analysing various risks’ likelihood and potential impact.

- Insurance

Enough insurance protection is crucial for guarding against possible losses brought on by prospective liabilities. Companies should conduct a thorough risk assessment and invest in insurance plans that address the necessary risks.

A few examples of this kind of insurance are general liability, product liability, directors and officers (D&O) liability, and professional liability. Insurance acts as a safety net, minimizing the negative effects of these liabilities on the company’s financial statements and protecting cash flow.

- Contractual Protections

Limiting potential liabilities requires carefully structured contracts. The obligations, responsibilities, and extent of each party’s liabilities in the event of a disagreement can be specified through clear and explicit contract terms. Including dispute resolution techniques like arbitration or mediation can aid in problem-solving more quickly and affordably.

Impact on Investors and Stakeholders

Contingent liabilities can greatly impact how stakeholders and investors see a company’s management, stability, and financial health. There are numerous approaches to observing the impact on investors and stakeholders:

- Valuation

Potential contingent liabilities may directly impact a company’s valuation. When calculating the company’s value, analysts and investors consider the inherent risks. If the firm’s these liabilities are substantial and their potential impact is severe, investors may give the company a lower valuation, which would cause the stock price to decline.

- Creditworthiness

When determining a company’s creditworthiness, lenders and creditors pay special attention to its contingent liabilities. High contingent liabilities could make it difficult for the business to fulfill its financial commitments, including debt repayments.

- Shareholder Confidence

Establishing and sustaining shareholder confidence requires open disclosure of contingent liabilities. When businesses provide clear and thorough information, investors and stakeholders are better informed about the company’s exposure to uncertainty. This can be achieved by describing potential risks and how they will be managed in the financial statements’ footnotes.

This openness encourages confidence in the company’s management and its dedication to overcoming possible obstacles.

Conclusion

The effective management of contingent liabilities is essential for a company’s long-term survival in today’s fiercely competitive business world.

Companies can ensure financial stability and sustainability by proactively managing these liabilities. This allows them to focus on innovation, growth, and strengthening their market position, thereby generating value for all parties involved.

Follow us at TradeAlone.com to stay updated with the latest market news.

Market Basics

The Impact of Options Trading on Stock Prices: A Comprehensive Analysis

Options trading can have a significant impact on stock prices, both directly and indirectly. In this article, we will explore the various ways in which options trading influences stock prices, including through delta hedging, volatility effects, and market sentiment.

1. Delta Hedging

Delta hedging is a trading strategy used by investors to mitigate the risk of changes in the price of an option by buying or selling the underlying asset. For instance, if an investor purchases a call option on a stock, they may also buy shares of the stock to offset the risk of a potential price decrease. This buying pressure created by delta hedging can contribute to pushing up the stock price.

2. Volatility Effects

Volatility plays a crucial role in options trading and can indirectly impact stock prices. Options prices tend to be higher when there is higher market volatility and lower when volatility is low. Investors are willing to pay more for options when they expect significant price movements in the underlying asset. Thus, an increase in options trading activity can lead to higher volatility in the underlying asset, which, in turn, may result in higher stock prices.

3. Market Sentiment

Options trading can be a reflection of market sentiment, which is a measure of how bullish or bearish investors feel about a particular asset. When there is a substantial amount of options trading on a specific stock, it can indicate a strong bullish or bearish sentiment towards that stock. This sentiment can influence stock prices in the direction of the prevailing sentiment.

4 . Supply and Demand Dynamics

The primary ways options trading impacts stock prices is through changes in supply and demand dynamics. As investors buy and sell options contracts, it affects the perceived interest in the underlying stock. When there is a surge in demand for call options (the right to buy the stock), it indicates bullish sentiment, potentially leading to higher stock prices. Conversely, an increase in demand for put options (the right to sell the stock) signals bearish sentiment and could result in lower stock prices.

5. Volatility and Implied Volatility

Options trading can introduce additional volatility to the stock market. The prices of options themselves are influenced by market volatility expectations, which are measured by implied volatility. If there is heightened uncertainty or news events surrounding a stock, implied volatility may rise, leading to more expensive options. As a result, the stock price may experience larger swings as traders adjust their positions to factor in the changing volatility.

6. Options Expiration and Pinning

Options have an expiration date, and as that date approaches, traders may adjust their positions or decide to exercise their options. This behavior can lead to increased trading activity and volatility as the expiration date nears. Additionally, “options pinning” or “options max pain” refers to the phenomenon where the stock price gravitates toward the price that causes the most options contracts to expire worthless, benefiting options writers. This pinning effect can influence short-term stock price movements, especially around expiration dates.

7. Hedging Strategies

Market makers and professional traders use options as part of their hedging strategies to manage risk in their portfolios. When they sell options, they often hedge their positions by buying or selling the underlying stock. This hedging activity can affect the stock’s price by creating additional buying or selling pressure. For instance, when market makers sell call options, they may buy the underlying stock to hedge against potential losses, leading to increased demand and higher prices.

8. Impact on Investor Sentiment

Options trading can impact investor sentiment and perception of a stock. Unusual options activity, such as a surge in call buying, may be interpreted as a signal of positive expectations for the stock’s future performance. On the other hand, heavy put buying might lead to negative sentiment and dampen the stock’s price.

9. The Small and Indirect Impact

While options trading can have a notable impact on stock prices, it is essential to understand that this influence is typically more pronounced in the short term rather than the long term. The effects can be more significant for highly liquid stocks with higher volatility levels. However, in general, the impact of options trading on stock prices might be small and challenging to predict due to the complexities of the options market and other influencing factors.

Option Pricing Model

Here is a table of the most common option pricing models:

| Model | Description |

|---|---|

| Black-Scholes model | A mathematical model that uses five inputs to price options: the strike price, the current stock price, the time to expiration, the risk-free rate, and the volatility. |

| Binomial model | A discrete-time model that prices options by assuming that the underlying asset can only move up or down by a certain percentage in each time step. |

| Monte Carlo model | A simulation-based model that prices options by randomly generating a large number of possible price paths for the underlying asset. |

| Heston model | A stochastic volatility model that prices options by assuming that the volatility of the underlying asset is itself a stochastic process. |

| SABR model | A simplified version of the Heston model that is easier to calibrate and use. |

The Black-Scholes model is the most widely used option pricing model, but it is not without its limitations. The model assumes that the underlying asset follows a geometric Brownian motion, which is a continuous-time random walk. This assumption is not always accurate, especially in the short term. The Binomial model and the Monte Carlo model are more accurate than the Black-Scholes model, but they are also more computationally expensive.

The choice of which option pricing model to use depends on a number of factors, including the type of option, the time to expiration, and the volatility of the underlying asset. In general, the Black-Scholes model is a good starting point, but it may be necessary to use a more complex model if the underlying asset is volatile or if the option has a long time to expiration.

| Model | Advantages | Disadvantages |

|---|---|---|

| Black-Scholes model | Simple to use, widely available | Assumptions may not be accurate |

| Binomial model | More accurate than the Black-Scholes model | Computationally expensive |

| Monte Carlo model | Most accurate option pricing model | Computationally very expensive |

| Heston model | More accurate than the Black-Scholes model | Assumptions may not be accurate |

| SABR model | Simplified version of the Heston model | Less accurate than the Heston model |

Conclusion

Options trading can exert both direct and indirect influence on stock prices. Delta hedging can create buying pressure on the underlying asset, pushing up stock prices. Volatility effects can result in increased options prices and subsequently higher stock price fluctuations. Additionally, options trading activity can reflect market sentiment, leading to stock price movements in the direction of prevailing sentiment. However, it is important to recognize that the impact of options trading on stock prices is typically more pronounced in the short term, and predicting its effects can be challenging. As with any investment activity, thorough research and consideration of the risks are crucial when engaging in options trading.

Visit Tradealone for more Updates

editor

What is Earnings per share (EPS) of a company?

What is the EPS of a company?

A simple and unbending meaning of EPS is Earnings per Share of the company. What is known as the earnings of a company? The earnings of a company refer to its net income, which is obtained after deducting the cost of goods sold (COGS), operating expenses, interest, and taxes from its total sales revenue. If we take a P&L statement of a company, the total revenue of a company is seen in the initial line items. This is followed by COGS, operating & admin expenses, and then interest and tax expenses. A P&L statement gives an investor the outline of the company’s earnings.

The formula to calculate the EPS of a company is EPS=Net income of the company/Total number of outstanding shares.

EPS is profit that belongs to the shareholders and it says us how much profit a company has earned for every share issued. Without much more explanation, let us go to the core of the article.

Let us see factors that fuel the EPS growth of a company

Factors Fuelling EPS Growth

- Increase in sales

- Increase in productivity

- Reduction in costs

- Reduction in interest caused by debt

- Expansion of business

Increase in sales

A company always aims to increase sales, but the strategies it uses makes a difference. The most effective way a company can improve its sales is by

- Establishing a better connection with customers by providing user-friendly products

- Use proper marketing and sales strategy to develop the business

- Improving the business model of the company by being financially healthy, engaging risk management, and hiring an efficient management team which propels future growth.

Increase in productivity

A company’s productivity increases when the employees make better use of their opportunities. The ways the company achieves it are

- Providing a learning platform for employees

- Implementing a flexible and attractive work culture.

- Paying the right worth of salary.

- Implementing the latest technology to attain efficiency.

Reduction in costs

The net income of a company can be improved in 2 ways. One happens when revenue is given importance, the other way is cutting costs. After all revenue and expenses form the crux of net income.

A company will handle different ways to cut its costs, they may lay off employees, close additional facilities, streamline supply-chain, cut costs on marketing and sales strategies, reduce outsourcing of work and hire efficient professionals and much more strategies are followed by companies to cut costs.

Reduce debt and interest

Debt is an obligation that involves a debtor and a creditor. Companies often borrow debt to expand their businesses or to fund the current business cycle. We can find debt in the liabilities section of a balance sheet. There as long-term and short-term debt. However, if a company’s current assets are higher enough to clear the debt the companies are debt-free. This debt incurs interest which weighs loads on the profitability of the business. Lesser the debt the company can have high earnings and eventually higher EPS.

Expansion of business

When a company wants to expand it is evident that the company has a well-established business. By expanding the company can acquire new customer concentration, increase profits, and launch new products or services. The most important strategy of expansion is eliminating insecurity held over a single market. Diversification happens and the company no longer needs 1 client or the same set of clients for its profits. This ultimately results in higher profits if the company plans strategically on expansion.

We understood the ways a company can increase its Earnings and ultimately the EPS. Now let us see a few companies which give consistent EPS growth over the years.

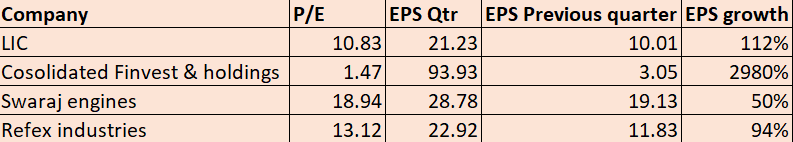

In this table, we can see a few stocks whose EPS grew innumerably higher from quarter to quarter.

We previously saw how an organization can improve its EPS through various steps, but consistency is the key. A company whose EPS growth is consistent over a period is very much attractive to investors.

How can an Investor profit from companies with consistent EPS growth?

- EPS gives is a direct synonym for a company’s profitability. A company that is financially stable gives steady EPS growth over the years.

- One of the crucial valuation ratios the PE ratio and PEG ratio depends on the value of EPS. The higher the EPS, the lower will be the PE ratio and companies with low PE ratio consistently attracts investors owing to their undervaluedness.

- Any investor considers 2 criteria before investing. One is the price appreciation of the asset, another is the periodic return generated. Which is also known as a dividend. A company with consistent growth in earnings indicates confidence in shareholders. An investor will prefer a company with a consistent dividend payout compared to one which is irregular in the payment of dividends.

- The company with consistent earnings growth looks promising and the market anticipates good future potential. This increases the price of the stock from which the investor gains profit.

Incorrect earnings

Sometimes the company registers an incorrect revenue in the P&L statement to create false beliefs about the company. They do this by holding the revenue of earlier quarters and accounting in them in consequent quarters to manipulate the investors despite the huge competition in the market regarding QoQ results. It is appropriate to look for the earnings transcript call in the investor presentation which explains the detailed revenue growth of the company.

In this article, we understood the meaning of EPS and the factors which fuel EPS growth. A table showing companies with excellent EPS QoQ growth was depicted. And we saw why a company with consistent EPS growth seems attractive to investors. EPS is a powerful metric when it is compared with its peers, or industry or even when it is compared over a period of time. EPS in solitary doesn’t depict the true picture of the company. An investor has to analyze the line items in the P&L statement beforehand. If the company registers consistent earnings growth, lies in blue ocean technology, is defensive to cyclicality, reduced debt, and controls expenses, you have spotted a multi-bagger!

-

Profit Making Idea1 year ago

Profit Making Idea1 year agoThe Grandfather Son (GFS) Strategy: A Technical Analysis Trading Strategy

-

Uncategorized8 months ago

Uncategorized8 months agoA BJP victory and the Stock Market: what to expect this monday

-

Technology5 months ago

Technology5 months agoInnovative Metro Ticketing Revolution in Pune by Route Mobile and Billeasy’s RCS Messaging. Stock trades flat

-

editor9 months ago

editor9 months agoHow to research for Multibagger Stocks

-

Trending12 months ago

Trending12 months agoDoes the “Tata-Apple venture” benefit Tata shares?

-

Finance World12 months ago

Finance World12 months agoHow Zomato Turned Profitable: A Landmark Achievement in the Indian Food Delivery Market

-

Market ABC8 months ago

Market ABC8 months agoSpotting an operator game: How to do it?

-

Market ABC1 year ago

Market ABC1 year agoThe Pullback Strategy: A Timeless Approach to Investment Success