auto

Mahindra & Mahindra Q3 Results: Solid Performance and Strategic Moves in the EV Space

In the third quarter of the financial year 2023-24, Mahindra & Mahindra Ltd. (M&M) showcased a strong performance across its automotive and agricultural sectors, coupled with significant strides in the electric vehicle (EV) market. Here’s a comprehensive overview of M&M’s achievements during this period, including a spotlight on its involvement in the electric cab service, Snap-E Cabs.

Market Leadership and Financial Growth

M&M continued its leadership in various segments, achieving notable market shares:

- SUVs: M&M remained the top choice with a 21.0% revenue market share.

- LCVs: Dominated the Light Commercial Vehicles segment with a 49.6% share.

- Tractors: Led the tractor market with a 41.8% share.

- Electric 3-Wheelers: Held a commanding 54% market share, with volumes up by 54%.

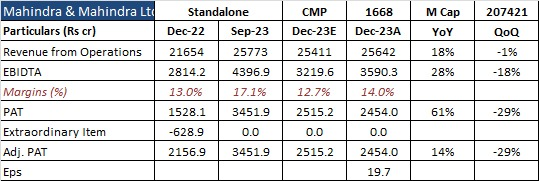

Financially, M&M reported a 15% increase in consolidated revenue for Q3, reaching Rs 35,299 crores. The consolidated Profit After Tax (PAT), adjusting for specific gains and impairments from the previous year, grew by 34% for Q3 and 33% Year-To-Date (YTD).

Operational Excellence

The quarter saw M&M achieving the highest ever Q3 volumes with a significant increase in UV and overall vehicle sales. The company’s strategy has led to a solid open booking figure for SUVs, reflecting ongoing strong demand.

The Auto segment’s standalone Profit Before Interest and Taxes (PBIT) surged by 56%, with a notable improvement in margins. These achievements underscore M&M’s operational excellence and profitability.

Expansion in the EV Sector

In addition to its traditional segments, M&M is making significant moves in the EV space. The company has played a pivotal role in the expansion of Snap-E Cabs, an electric cab service in West Bengal. Through partnerships with Mufin Green Finance, Mahindra & Mahindra Finance, ICICI, and HDFC Bank, Snap-E Cabs has increased its fleet to 600 cars in Kolkata. This collaboration not only enhances M&M’s presence in the EV market but also supports sustainable urban mobility solutions.

Future Outlook

With its solid Q3 performance, M&M is well-positioned for continued growth and innovation. The company’s strategic focus on electric mobility, coupled with its leadership in traditional automotive and agricultural machinery sectors, sets a strong foundation for future success. M&M’s involvement in expanding Snap-E Cabs’ fleet further emphasizes its commitment to sustainable transportation solutions and marks an important step in its EV journey.

Check our report on Tata Motors Vs Mahindra and Mahindra here . Comment below your choice for the best Automobile company for next 5-10 years view.

As M&M moves forward, its blend of operational excellence, market leadership, and strategic investments in the EV sector will likely continue to drive growth and innovation, redefining mobility and agricultural solutions on both domestic and global scales.

Disclaimer: This blog provides an overview of Mahindra & Mahindra Ltd.’s performance in Q3 FY24 and its strategic initiatives in the electric vehicle sector. The details presented are based on publicly available information and are intended for informational purposes only.

auto

Revolt Motors from Rattan India Enterprise is Electrifying India’s Urban Mobility with 15 New Dealerships

Revolt Motors, a popular brand of electric motorcycles in India and a proud subsidiary of RattanIndia Enterprises Limited, is expanding in the urban mobility landscape. With the launch of fifteen new dealerships across the nation, Revolt Motors’ network now boasts an impressive tally of 115, solidifying its commitment to lead the electric revolution. This strategic expansion into states like Bihar, Goa, Gujarat, Jharkhand, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Uttar Pradesh, and West Bengal marks a significant milestone in Revolt Motors’ journey towards sustainable urban mobility. Coupled with the increasing trend of EV vehicles, we feel this will definitely improve the sales and stock price of the company.

The Vision of Expansion:

Mrs. Anjali Rattan, the dynamic Business Chairperson of RattanIndia Enterprises Limited, shared her enthusiasm about this massive growth. “This expansion fills us with immense pride and propels our vision for a greener future forward. We’re thrilled about the new avenues these dealerships open up,” she stated. Further she emphasized the brand’s commitment to revolutionising urban mobility across the Indian subcontinent.

Ultramodern Dealerships for the Modern Rider:

Besides expanding its footprint Revolt Motors is also redefining the customer experience. The new dealerships are designed as modern havens where biking enthusiasts can immerse themselves in the world of electric motorcycles. Moreover, each location offers a comprehensive suite of services — from sales to after-sales support, genuine spare parts to technical assistance — ensuring that every visitor leaves as a well-informed customer, possibly even as a new member of the Revolt family.

Test Rides and Tech Talks:

What sets these dealerships apart is the opportunity for potential customers to engage directly with Revolt’s cutting-edge technology. Test rides offer firsthand experiences of the exhilarating performance, while in-depth discussions provide insights into the motorcycles’ advanced features and the AI technology that powers them. It’s an invitation to explore, question, and connect with the future of urban mobility.

Should you buy Rattan India Enterprise stocks?

The stock price of Rattan India Enterprise has more than doubled over the past year, alongside a significant increase in their profits. The company, active in drones, electric bikes, and other EV spaces, has captured the interest of the nation’s youth with its Revolt bikes. This popularity positions them well for further market share gains in the future. While we cannot issue a buy or sell recommendation, we believe retail players should definitely pay attention to this company.

Revolt Intellicorp: Leading the Charge:

Since its inception in 2017, Revolt Intellicorp has been at the forefront of India’s electric vehicle revolution. The introduction of the country’s first AI-enabled motorcycle was just the beginning. Today, Revolt continues to blend innovation with performance, offering not just motorcycles but a comprehensive riding experience that includes a range of genuine parts and accessories.

Since we are talking about EV, checkout this blog on Tesla entry in India this year.

RattanIndia Enterprises: Innovating for a New India:

RattanIndia Enterprises Limited, the powerhouse behind Revolt Motors, is reimagining the landscape of new-age businesses. From electric mobility and e-commerce to fashion, fintech, and drones, RattanIndia is on a mission to make a significant impact on the lives of millions. Each venture is a step towards a future where technology and sustainability converge to create a smarter, greener world.

Join the Revolt:

As Revolt Motors continues to expand its horizon, the invitation is open to all to join in reshaping the future of urban mobility. To find out more about Revolt Motors, explore their innovative electric motorcycles, or locate the nearest dealership, visit www.revoltmotors.com or reach out at pr@rattanindia.com.

Conclusion:

The expansion of Revolt Motors is more than just an increase in numbers; it’s a testament to the growing acceptance and enthusiasm for electric vehicles in India. With each new dealership, Revolt Motors inches closer to a future where every ride is green, efficient, and electrifying. Let’s ride into the future, together. Also follow Tradealone for more such EV stocks related news.

auto

Ashok Leyland Embarks on Clean Mobility Journey with New Greenfield Plant in Uttar Pradesh

Ashok Leyland, the esteemed flagship of the Hinduja Group and a frontrunner in India’s commercial vehicle manufacturing, has taken a significant leap towards sustainable mobility. On February 20, 2024, in Lucknow, Uttar Pradesh, the company celebrated the groundbreaking of a new integrated commercial vehicle plant. This facility is not just another addition to its manufacturing prowess but a dedicated move towards green mobility, heralding a new era for the commercial vehicle industry in India.

The Foundation of Sustainability

The ceremonial laying of the foundation stone was honored by the presence of Shri Yogi Adityanath, the Hon’ble Chief Minister of Uttar Pradesh. This momentous event also saw the attendance of key figures such as Shri Suresh Khanna, Minister of Finance & Parliamentary Affairs, Govt of Uttar Pradesh, Shri Nand Gopal Gupta, Minister for Industrial Development, Export Promotion, NRI, and Investment Promotion, along with senior members of the Hinduja family, and a host of dignitaries, dealers, customers, and suppliers of Ashok Leyland.

A Green Future in Manufacturing

Spanning over 70 acres, the Kanpur Road, Lucknow facility is set to become Ashok Leyland’s most modern and environmentally friendly factory globally. It aims to set world-class manufacturing standards, focusing primarily on the production of electric buses. This facility will also be capable of manufacturing vehicles powered by other alternative and emerging fuels, signifying a broad spectrum approach towards clean mobility.

Leadership Insights

Dheeraj Hinduja, Executive Chairman, Ashok Leyland, emphasized the plant’s role in shaping the future of sustainable mobility in India. He expressed confidence in the facility’s contribution towards employment generation and the advancement of green mobility solutions. The company’s commitment to innovation and achieving Net Zero emissions goals was also highlighted as a key driving force behind this initiative.

Shenu Agarwal, MD & CEO of Ashok Leyland, pointed out the facility’s pivotal role in addressing the growing demand for electric vehicles and its significance in the holistic development of the region. The focus on electric trucks and buses aligns with the evolving landscape of sustainable transportation, marking a step forward in building a green mobility future.

Expanding Capacities for a Sustainable Future

Initially, the plant will have the capacity to produce 2,500 vehicles per year, with plans to double this output to 5,000 vehicles annually over the next decade. This expansion is in anticipation of the increasing demand for electric and other alternative fuel vehicles.

Uttar Pradesh is already leading the charge in electric mobility, boasting the highest number of registered Electric Vehicles (EVs) in India. Ashok Leyland’s new plant further reinforces the state’s commitment to eco-friendly transportation solutions.

Recently Ashok Leyland posted great number in the Q3 results. Also, we see a continues appreciation on the stock price as well.

A Strategic Step for Ashok Leyland

This greenfield facility represents a strategic initiative by Ashok Leyland, positioning the company at the forefront of the green mobility revolution in the state and beyond. With this being Ashok Leyland’s seventh vehicle plant in the country. Therefore, the company continues to reinforce its commitment to innovation, quality, and sustainability.

About Ashok Leyland

As a pioneer in the commercial vehicle space, Ashok Leyland stands as the 2nd largest manufacturer of commercial vehicles in India and holds prominent positions globally in the bus and truck manufacturing sectors. With a rich legacy spanning 75 years and a presence in over 50 countries, Ashok Leyland remains dedicated to driving progress through continuous innovation and contributing to India’s growth story. Moreover, we feel this move will positively reflect on the stock price movement for Ashok Leyland tomorrow.

This new venture in Uttar Pradesh is a testament to Ashok Leyland’s enduring vision: “Koi Manzil Door Nahin,” echoing the belief that no destination is too distant when pursued with resilience and innovation.

auto

ICICI Direct forecasts a 25% increase for Gabriel India, setting a stock target of 440 Rupees

Gabriel India (GABIND), a leading shock absorber manufacturer, has recently showcased a robust performance in Q3FY24, signaling promising growth avenues for investors. With a diversified product range spanning two-wheelers (2-W), three-wheelers (3-W), passenger vehicles (PV), commercial vehicles (CV), railways, and the aftermarket segment, Gabriel India stands on solid ground, prepared for future expansion. This blog post delves into the company’s latest financial achievements, strategic partnerships, and what lies ahead for investors.

Q3FY24 Financial Highlights for Gabriel India

Gabriel India reported a net sale of Rs 814 crore in Q3FY24, marking a 14% increase year-on-year (YoY). EBITDA stood at Rs 70 crore, with EBITDA margins slightly up by 10 basis points quarter-on-quarter (QoQ) to 8.6%. The profit after tax (PAT) saw a remarkable 48% YoY increase, reaching Rs 43 crores. Strategic collaborations with TVS Motors, Bajaj Auto, Tata Motors, and Maruti Suzuki India Limited (MSIL) have positioned Gabriel India for industry-leading growth.

Strategic Ventures and Market Expansion

Gabriel India’s move into the passenger vehicle and specifically the SUV segment, where it currently holds approximately 35% of the domestic market share, exemplifies its strategic focus. The company’s joint venture with Inalfa, the world’s second-largest sunroof manufacturer, marks its foray into premium segment offerings, further diversifying its product portfolio.

Investment Thesis

Gabriel India’s strategic emphasis on the PV-SUV space and its venture into the premium sunroof market are significant positives. With a cash-rich balance sheet, boasting a net cash surplus of ~₹300 crore as of FY23, and a history of healthy double-digit return ratios, Gabriel India presents a compelling case for investors. The company’s vision to rank among the top 5 global shock absorber players by 2025, coupled with its EV-agnostic product profile, underlines its long-term growth potential.

Financial Outlook

Gabriel India is poised for a robust financial trajectory, with an expected sales/PAT CAGR of 10%/24% over FY23-26E. The company’s focus on capital efficiency and a healthy balance sheet promises a RoCE of ~22% by FY26E. With the automotive industry’s landscape evolving rapidly, Gabriel India’s strategic investments and diversified product portfolio set the stage for sustained growth.

Market Positioning and Rating

ICICI Securities assigns a “BUY” rating to Gabriel India, with a target price of Rs 440, reflecting a potential 20% increase. Moreover, this optimistic outlook is based on the company’s industry-leading growth prospects, double-digit margin aspirations, and strategic positioning in the EV and PV-SUV spaces.

Conclusion

Gabriel India’s Q3FY24 performance and strategic ventures highlight its readiness to capitalize on the automotive sector’s evolving dynamics. For investors seeking opportunities within the automotive ancillary space, Gabriel India offers a blend of growth, innovation, and financial robustness. As the company continues to expand its footprint and diversify its offerings, it remains a noteworthy candidate for investment portfolios.

Engage with us in the comments section below. Share your views on Gabriel India’s strategic direction, its impact on the automotive ancillary market, and its potential as an investment opportunity.

Also read the full report by ICICI Direct here.

-

Profit Making Idea1 year ago

Profit Making Idea1 year agoThe Grandfather Son (GFS) Strategy: A Technical Analysis Trading Strategy

-

Uncategorized8 months ago

Uncategorized8 months agoA BJP victory and the Stock Market: what to expect this monday

-

Technology5 months ago

Technology5 months agoInnovative Metro Ticketing Revolution in Pune by Route Mobile and Billeasy’s RCS Messaging. Stock trades flat

-

editor9 months ago

editor9 months agoHow to research for Multibagger Stocks

-

Trending12 months ago

Trending12 months agoDoes the “Tata-Apple venture” benefit Tata shares?

-

Finance World12 months ago

Finance World12 months agoHow Zomato Turned Profitable: A Landmark Achievement in the Indian Food Delivery Market

-

Market ABC8 months ago

Market ABC8 months agoSpotting an operator game: How to do it?

-

Market ABC1 year ago

Market ABC1 year agoThe Pullback Strategy: A Timeless Approach to Investment Success