Technology

Management Commentary on Multibagger Stock Datamatics Q3 Results

As of today, Datamatics Global trades at 606 rupees, following a 20% decline from the levels of 720 after the release of disappointing Q3 numbers. However, in the latest quarter earnings call, Datamatics Global Services Limited provided some insightful updates on its performance, project delays, revenue guidance, and strategic initiatives aimed at fostering growth. Let’s dive into the key highlights from the Q&A session that paint a picture of Datamatics’ journey through Q3 and its outlook for the future.

Project Delays and Impact on Revenue for Datamatics

Rahul Kanodia, a key figure at Datamatics, addressed concerns regarding project delays that have slightly dented the revenue, attributing to slower project takeoffs and decision-making processes. He mentioned that these delays, particularly in Q3, were somewhat out of their control but emphasized that the company is gearing up for a stronger Q4 to compensate for the slow quarter.

Revenue Growth Expectations for Datamatics

Looking ahead, the company has set an optimistic growth target for Q4, anticipating an 11-12% sequential quarter growth. This growth is expected to bring the full-year top-line growth to around 4.5%-5%, a testament to the company’s resilience and strategic planning despite the challenges faced in the earlier quarters. A 5% revenue growth for an IT company in these times is a decent performance. With improved margins we expect Datamatics to clock a 7% profit growth YoY.

Use of Cash for Inorganic Growth

The discussion also moved towards the use of cash for inorganic growth, with Kanodia revealing that the company is in active dialogue with several companies after reviewing over 200 potential opportunities. This proactive approach hints at Datamatics’ strategic intentions to bolster its portfolio and market presence through acquisitions. Well, Datamatics has over 500 crores of excess cash in books. An acquisition here will further boost the profits of this Multibagger stock.

Outlook Across Various Segments

Addressing queries on segment-wise performance and outlook, Kanodia shared that all segments witnessed an even performance, impacted by the overall slowdown. However, he remains optimistic about margin improvements in the next financial year, thanks to initiatives in automation across the board. As Datamatics is focused on AI, they want to automate several processes to improve on the overall margins.

Digital Technologies Segment

The digital technologies segment, in particular, is expected to see margin improvements next year, driven by increased productivity through AI and automation. This focus on tightening productivity metrics underscores Datamatics’ commitment to enhancing its service offerings and financial health.

New Contracts and Product Feedback

Kanodia highlighted the company’s recent contract wins and the healthy pipeline of $245 million, maintaining a robust rate of closing new customers. Feedback on the product side, especially in dialogues with giants like Microsoft, has been very positive, indicating strong potential for future growth.

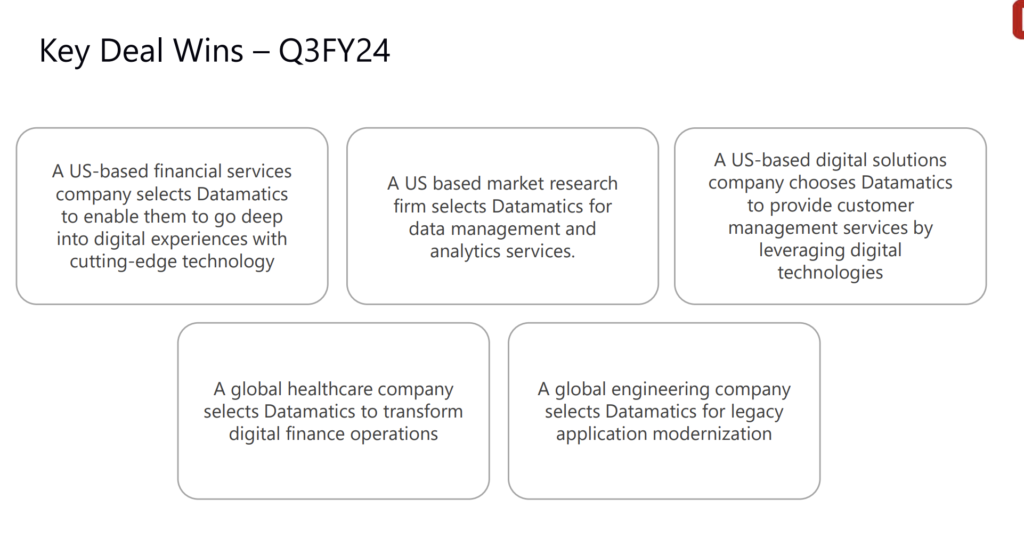

Lets take a look at the key deal wins this quarter –

Metro Projects and Pricing Strategy

The company’s involvement in metro projects in India and the US was discussed, showcasing Datamatics’ diversified project portfolio. On pricing, Kanodia was cautious, suggesting that the focus for the next year would be on improving margins and productivity rather than relying on price increases. Since, Indian Metro fare collection projects do not have substantial margins, Datamatics is currently more interested in the European and American market for similar projects. Mr. Kanodia further informed about 4 such automated fare collection projects that they are after in the western soil.

Margin Improvement and Future Outlook

Finally, the conversation touched on the expected margin improvements, with an anticipation of better EBITDA margins in the coming year due to automation and other efficiency measures. Despite the macroeconomic uncertainties, Datamatics is in the process of detailed planning for the next financial year, promising an update in the subsequent earnings call.

Conclusion

Datamatics’ Q3 earnings call was a blend of mixed reflections on past challenges and an optimistic outlook for the future. With a clear strategy focused on growth, efficiency improvements, and strategic acquisitions, Datamatics is navigating through the turbulence with resilience and foresight. As investors and stakeholders look forward to the next quarter, there’s a palpable sense of anticipation for what’s to come for this evolving multibagger stock.

We expect Datamatics to perform well as the company have a range of segments and product offerings. The low PE at which the stock trades further boosts up the confidence for price appreciation. Remember, this is not a buy or sell suggestion.

Stay tuned for more updates on Datamatics and other market movers. Your insights and engagement drive our discussions and help us explore the dynamic world of finance and technology together.

Technology

L&T plans to extend AI expertise with help from NVIDIA

L&T Technology Services, often called L&T Tech, is a company that helps other businesses with their technology needs. They do things like designing new products, improving existing ones, and making sure everything works smoothly. Basically, they’re like a helpful friend for companies who need a hand with technology stuff.

L&T is going to use stuff from NVIDIA, which is a company that makes really smart tech by AI driven chips. From March 18-21, they’ll be at an AI event by NVIDIA to learn more and share ideas.

What’s the plan? They want to make AI better and use it in lots of places, like in making cars, in hospitals, and in factories. They’ll learn about making AI that can talk and listen, help make things faster and better, and even help doctors with their work.

Amit Chadha, who’s in charge at L&T Technology Services, says they want to use what they learn to help solve real problems and help people all around the world.

NVIDIA is pretty happy to work with them. They think that together, they can make AI do even more amazing things for businesses and everyone else. Shanker Trivedi from NVIDIA is looking forward to seeing all the cool stuff they can do together.

So, what’s L&T Technology Services? It’s a part of a bigger company called Larsen & Toubro Limited, and they focus on creating new tech and researching. They work with many big companies and have lots of people working in offices and labs all over the place.

Want to know more? You can check out our website!

Technology

TCS Secures Global Top Employer Title for 2024

Tata Consultancy Services (TCS) shines again, getting the Global Top Employer certification for the ninth straight year. Recognized by the Top Employers Institute, TCS stands out for its exemplary people practices across the globe.

Celebrating Excellence in People Practices

The Top Employers Institute, a beacon of excellence in HR practices, has spotlighted TCS among just 16 global organizations. This prestigious acknowledgment underscores TCS’s leadership in fostering an innovative and supportive workplace.

A big name for Employee Health and Wellness

TCS’s commitment to its employees’ health and wellness has not gone unnoticed, ranking second in this critical category. This achievement highlights TCS’s dedication to nurturing a healthy and productive work environment.

A Global Recognition

Spanning continents, TCS has been named a top employer in over 32 countries, including hotspots in Europe, the Middle East, and Asia. This global accolade is a testament to TCS’s unwavering commitment to its team, guided by the Tata Group’s venerable values.

Empowering a Diverse Workforce

With a vibrant tapestry of over 603,305 employees from 153 nationalities, TCS champions diversity. Women represent a significant 35.7% of its global workforce, emphasizing the company’s inclusive ethos.

A People-Centric Approach

David Plink, CEO of the Top Employers Institute, lauds TCS for its people-centric vision. This recognition cements TCS’s reputation as a prime employer, deeply committed to employee growth and engagement.

Innovative Initiatives

TCS’s notable programs like the Engagement with Purpose framework and the TCS Elevate program underscore its pioneering approach to talent development and employee engagement.

A Holistic Well-being Vision

TCS’s wellness initiatives, including TCS Cares and TCS Fit4Life, support not just the physical but also the mental well-being of its employees, setting a benchmark in the industry.

Championing Talent Engagement

Milind Lakkad, Chief Human Resources Officer at TCS, reflects on this honor as a validation of TCS’s global talent engagement and transformation practices. He takes pride in TCS’s industry-leading retention rates and the visible impact of its people practices.

Investing in Future Skills

TCS is forward-looking, investing heavily in upskilling its workforce in next-gen technologies. Initiatives like training in GenAI and the Contextual Masters™ program propel TCS employees towards future readiness.

Fostering a Culture of Continuous Learning

TCS has cultivated an environment where learning never stops. With millions of learning hours clocked, TCS employees stay at the forefront of technology and innovation.

Supporting Young Talent

TCS is also committed to nurturing young minds through various STEM initiatives, ensuring a robust talent pipeline for the future.

About Top Employers Institute and TCS

The Top Employers Institute globally recognizes HR excellence, impacting millions of employees. Tata Consultancy Services, a giant in IT services and consulting, continues to pave the way for a better world of work, guided by its rich heritage and commitment to sustainable growth.

Stay tuned to witness how TCS continues to redefine the workplace and lead with innovation and compassion.

Technology

Tata Elxsi makes a Big Move into Cloud Infrastructure. Will the share move like Kpit Tech finally?

Tata Elxsi, a big company known for design and technology services provider for Automotive, Broadcast, Communications, Healthcare, and Transportation is getting into a partnership with Telefónica. Telefónica is a big name in the world of phones and internet. They’ve successfully implemented true cloud-natve infrastructure management powered by ETSI Open-Source MANO (ETSI OSM). This is a big deal because it makes managing the internet stuff easier and faster for companies.

What is this deal about?

Tata Elxsi and Telefónica worked together to make the internet’s infrastructure (which is a fancy way of saying the basic building blocks of the internet) better and more automatic. They used something called OSM from ETSI, which is a group that makes rules for the internet, to do this. It’s like they’ve built a smarter brain for the internet that can manage things on its own, making everything from watching videos to sending emails smoother.

Making Things Simpler and Faster

By joining hands, these two companies have made some cool new tools. These tools help make managing the internet stuff simpler, allowing things to run without needing a person to watch over them all the time, and even letting companies use different cloud services easily. It’s kind of like having a super-smart robot that knows how to handle all the internet things by itself.

Kpit Tech and Tata Elxsi

People are wondering if Tata Elxsi will start doing as well as KPIT Tech, another company that’s been doing really great with similar tech stuff. A few years back, everyone was trying to guess which one of these companies would be the best bet for making money in the long run. KPIT Tech has been hitting new highs, but Tata Elxsi has had a tough time getting past its top performance from August 2021 because it hasn’t been growing as fast as people hoped.

But now, with Tata Elxsi diving into cloud infrastructure, which is all about making the internet work better, things might start looking up. This new move could be their chance to catch up and maybe even get ahead in the game.

What Does This Mean for You?

If you’re watching these companies to see where to invest your money, this new development is worth paying attention to. Tata is stepping into the cloud game could turn out to be a great move, making it an interesting option for people looking to invest in tech companies. However, we are still not sure how much revenue will this initiative make for Tata.

So, will Elxsi soar like KPIT Tech now that they’re getting into the cloud infrastructure scene? Only time will tell, but it’s definitely a space to watch!

Want to know why Tata Elxsi is underperforming despite decent profit growth? Check this blog –

Tata Elxsi and Telefónica’s partnership is a big step into a future where managing the internet could become a lot easier and smarter. As they push forward, we’ll be watching to see how this impacts the tech world and whether Tata Elxsi can climb to new heights in the industry.

-

Profit Making Idea1 year ago

Profit Making Idea1 year agoThe Grandfather Son (GFS) Strategy: A Technical Analysis Trading Strategy

-

Uncategorized8 months ago

Uncategorized8 months agoA BJP victory and the Stock Market: what to expect this monday

-

Technology5 months ago

Technology5 months agoInnovative Metro Ticketing Revolution in Pune by Route Mobile and Billeasy’s RCS Messaging. Stock trades flat

-

editor9 months ago

editor9 months agoHow to research for Multibagger Stocks

-

Trending12 months ago

Trending12 months agoDoes the “Tata-Apple venture” benefit Tata shares?

-

Finance World12 months ago

Finance World12 months agoHow Zomato Turned Profitable: A Landmark Achievement in the Indian Food Delivery Market

-

Market ABC8 months ago

Market ABC8 months agoSpotting an operator game: How to do it?

-

Market ABC1 year ago

Market ABC1 year agoThe Pullback Strategy: A Timeless Approach to Investment Success