Finance World

Pidilite Industires- A Bond Beyond Business

Pidilite Industries Limited is an Indian multinational company known for its diverse product portfolio in adhesives, sealants, construction chemicals, and consumer products. With its headquarters in Mumbai, India, Pidilite Industries Limited was established in 1959. The business has a long history of developing novel solutions for both industrial and consumer needs. With a strong presence in both domestic and international markets, Pidilite has established itself as a leading player in various industries.

Strategy

Pidilite commands a monopoly in the Adhesive and Sealants segment. This it gained by following a comprehensive strategy model based on the 4 Ps of Marketing. The 4 Ps of the marketing strategy, also known as the marketing mix, are key elements that organizations use to effectively promote and sell their products or services. These 4 Ps include Product, Price, Place, and Promotion.

Companies by developing a thorough marketing plan that successfully places their product in the market. Such that it draws customers, and boosts sales by carefully controlling these 4 Ps.

Product Strategy

Pidilite’s in-house research and development is one of the reasons behind its success. Pidilite has a robust research and development division that aids in producing cutting-edge items for the business.

Adhesives and sealants, art materials and stationery, fabric care, construction and paint chemicals, automotive chemicals, textile resins, and organic pigments and preparations are among the products that Pidilite sells. Additionally, Pidilite offers industrial specialty items such as footwear, pigment powder, industrial resins, and industrial adhesive.

A few of its popular products include the following: Fevicol Fevistick, M-Seal, Fevikwik, Dr. Fixit.

Pidilite’s Pricing Strategy

Pidilite Industries Limited has adopted a well-defined pricing strategy as part of its overall marketing approach. In order to expand its market reach, it uses competitive pricing. Some products start as low as Rs 5.

Its retail margins vary between 12% and 25%, depending on the specific product. Other competitors can play with the margins however, Pidilite provides superior quality, enabling them to outperform their competitors.

Place and Distribution Strategy

Pidilite has an extensive network of distributors and retailers. Its distribution network extends beyond tier 1 cities, as the company aims to increase its penetration in tier 2, tier 3 cities, and rural areas. Pidilite has a network of more than 4000 distributors and 400000 retailers at its disposal. This allows its products to be shopped from a variety of vendors, giving it a significant competitive advantage.

It has also spread its business in the international market after its success on Indian soil.

Products are available in around 100+ countries like the United States of America, United Kingdom, Singapore, Bangladesh, Sri Lanka, Indonesia, Egypt, Thailand, United Arab Emirates, China, South Africa, and Ghana.

Promotion and Marketing Strategy

‘Bhaiya ek Fevicol dena’

Do you recall how Fevicol became synonymous with glue in everyday life? One simply would not settle for anything less. Due to its engaging and memorable campaign, Fevicol became a household name.

Pidilite spends a considerable amount on sales and marketing of its products and overall brand image. It has consistently created clever commercials and memorable jingles to capture the attention of customers. The advertising is widely praised for its excellent substance, inventiveness, and connection to the target audience.

Effective Marketing Campaigns

Fevicol’s marketing ads are not just ads, there are a part of our childhood. From the 90s till now, they have become a part of every household. So much that the mentioned ones will surely send you back in time and relive the carefree days. Some of them are.

- Fevicol Sofa (You’ve got to remember this!)

- Fevicol Cliffhanger

- Todo Nahi Jodo

- Fevicol Bus

- The Leakage Man – A Dr. Fixit Marketing Campaign

- FEVIKWIK started a social media campaign to recognize clumsy people who frequently unintentionally damage things by referring to them as “Fevikwik stars.” Numerous people related their personal experiences with the Fevikwik stars.

- Chehrey Par Mask Aur Do Gaz Ki Doori, Abhi Bhi Hai Bohot Zaroori – A Fevicol Marketing Campaign

Such successful campaigns made Fevicol and other products household names, capturing significant market share.

Awards for Marketing Campaigns

- Pidilite bagged 30+ advertising & marketing awards during the year.

- EFFIE Gold for Fevikwik’s “Phenko Nahi Jodo” campaign.

- Kyoorius Blue Elephant for Fevicol’s social distancing campaign.

- Silver in the Household Maintenance Products category at the 2002 Cannes for Fevicol Bus

Pidilite’s Fundamentals

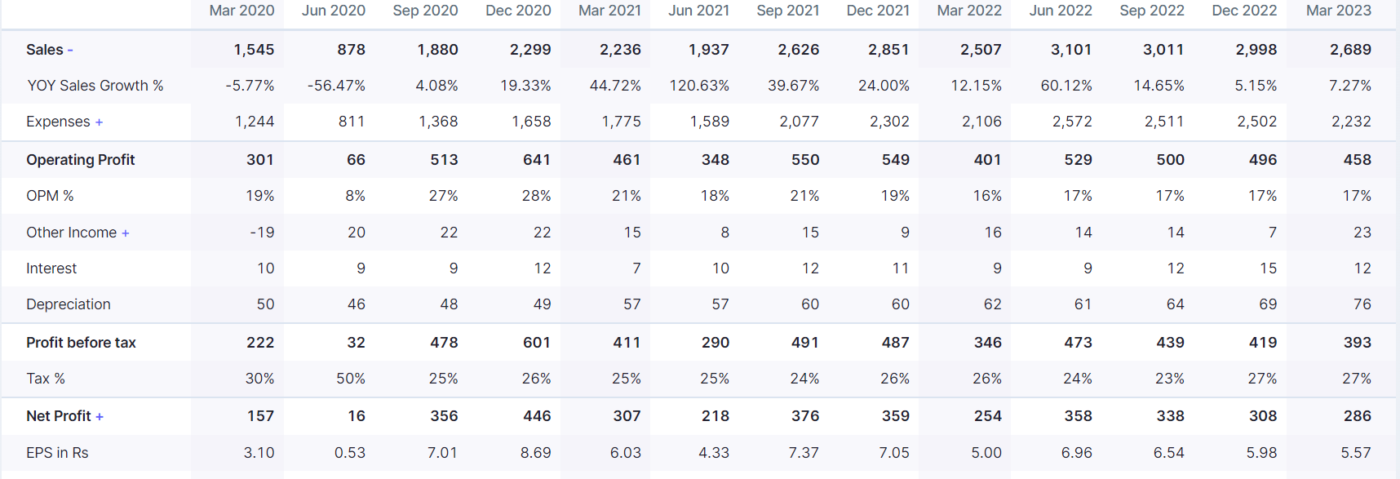

Quarterly Results

The fiscal year 2022’s ending quarter brought in around Rs 283 crore in consolidated net profit YoY. This is an 11.28 percent increase compared to the March quarter of the previous year’s Rs 254.35 crore.

EBITDA i.e., Earnings Before Interest, Tax, Depreciation, and Amortization, YoY grew by almost 14.50 percent. EBITDA for the March quarter stood at Rs 459.16 crore. The corresponding quarter of the previous fiscal year’s EBITDA we recorded a net of Rs 401.08 crore.

Net sales brought in Rs 2689.25 crore. That is a 7.27 percent YoY increase in revenue which for the previous March quarter was at Rs 2507.10 crore.

Annual Results

Annual consolidated net profit increased by 5.44 percent. Net profits stood at Rs 1273.25 crore compared to last financial year’s Rs 924.91 crore.

EBITDA saw a 7.42 percent increase this year coming at around Rs 1984.37 crore against last year’s Rs 1368.21 crore.

Net revenue grew by 18.93 percent this financial year. It brought in Rs 11799.10 crore against last year’s Rs 7077.96 crore.

| | ANNUAL | FY 2023 | FY 2022 | FY 2021 | FY 2020 | FY 2019 |

| Total Revenue | 11,848.71 | 9,957.26 | 7,372.11 | 7,443.90 | 7,224.60 |

| Total Revenue Growth (%) | 19.00 | 35.07 | -0.96 | 3.04 | 16.02 |

| Total Expenses | 10,132.11 | 8,355.36 | 5,849.98 | 5,921.97 | 5,868.56 |

| Total Expenses Growth (%) | 21.26 | 42.83 | -1.22 | 0.91 | 20.44 |

| Profit after Tax (PAT) | 1,273.25 | 1,207.56 | 1,131.21 | 1,116.42 | 924.91 |

| PAT Growth (%) | 5.44 | 6.75 | 1.32 | 20.71 | -3.89 |

| Operating Profit Margin (%) | 14.95 | 16.57 | 21.38 | 21.32 | 19.52 |

| Net Profit Margin (%) | 10.79 | 12.17 | 15.51 | 15.30 | 13.06 |

| Basic EPS (₹) | 25.05 | 23.76 | 22.26 | 21.98 | 18.21 |

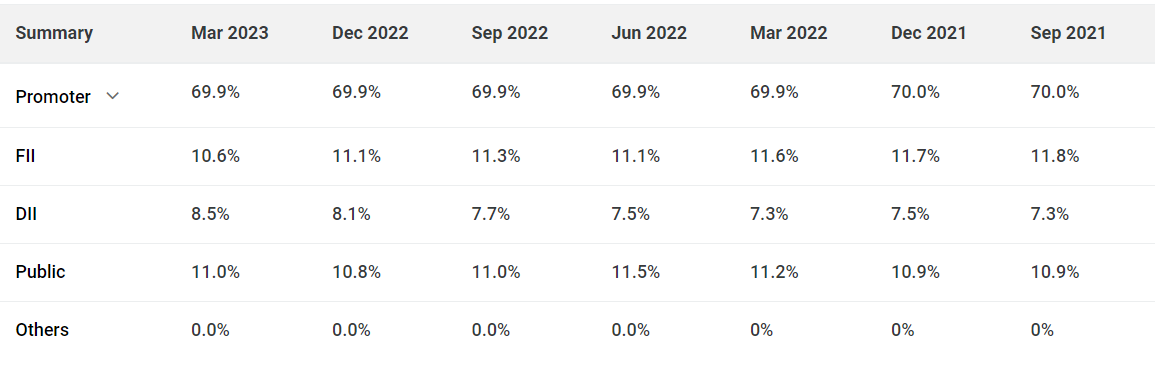

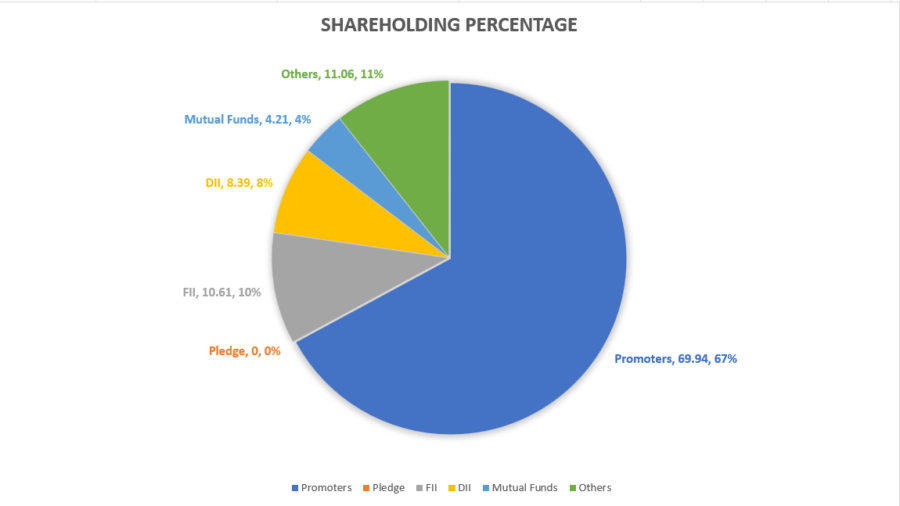

Shareholding pattern

During this quarter, the Indian promoter’s holdings in the company remained stable at approximately 69.94 percent. The DII demonstrated their confidence by increasing their holdings from 7.73 percent in September to 8.46 percent in the March quarter.

Conversely, FII holdings decreased from 11.08 percent to 10.61 percent according to the latest reports.

Peer comparison

| NAME | P/E (X) | P/B (X) | ROE % | ROA % | REV CAGR [3YR] | OPM |

| Pidilite Ind | 104.32 | 17.84 | 17.65 | 12.09 | 16.58 | 14.95 |

| Asian Paints | 78.1 | 19.5 | 25.67 | 15.91 | 19.14 | 16.78 |

| SRF | 30.48 | 6.38 | 20.93 | 11.52 | 26.91 | 20.36 |

SWOT Analysis of Pidilite

Strengths

-

Strong Brand Portfolio

Pidilite has a diverse and well-established brand portfolio, including popular brands like Fevicol, Fevikwik, Dr. Fixit, and M-seal. These brands enjoy high consumer trust and loyalty, providing a competitive advantage in the market.

-

Market monopoly

With regard to the adhesive industry, Pidilite has established a monopoly made possible by the success of its main brand, Fevicol. Around 70% of the market is controlled by Fevicol.

-

Extensive Distribution Network–

The company has a robust distribution network spanning across various regions in India and globally. This enables Pidilite to reach a wide customer base and ensures efficient product availability and timely delivery.

-

Global presence

With manufacturing plants in more than 9 nations, Pidilite is also present in more than 100 nations. Their wide variety of goods are available in most developed nations.

-

R&D

Pidilite Industries Limited has been a leader in consumer and specialty chemicals in India since its founding in 1959. Pidilite uses strong, research-driven innovation combined with user feedback to create the majority of its goods with an in-house research team. Additionally, Pidilite founded a cutting-edge research facility in Singapore that is currently a member of the Singapore Chemical Industry Council (SCIC).

-

A strong bond

In addition to their strong marketing campaigns and extensive distribution network, what truly sets Pidilite apart is their deep-rooted dedication to strengthening bonds. The company is committed to nurturing strong bonds and their approach exemplifies this philosophy. Pidilite understands the value of staying connected to ground reality, and this is reflected in every aspect of their operations. This is one such example.

‘I work as an assistant plumber in Vizag. My daily livelihood was lost because of the lockdown, and I was worried about supporting my family amid this crisis. I did not expect that any Company will come to the plumber community’s rescue in this pandemic. While no other company has interacted personally with us during the lockdown, Pidilite officials have been in touch with us since the first week of lockdown to remain apprised of our well-being. Pidilite officials did not just interact with us over call, they also met us and distributed essential grocery items to help us make ends meet. I am thankful to Pidilite for thinking about us during this crisis.” Mr. Ravi Kumar Plumber

Weaknesses

-

Dependency

The majority of Pidilite’s revenue comes from a small number of flagship brands. Despite the company having a strong portfolio of brands, more than 50 percent of the revenue is dependent on Fevicol and M-Seal. Due to this dependence, the business is at danger for brand saturation, shifting consumer preferences, or possible brand dilution.

Opportunities

-

Expansion into Emerging Markets

Pidilite has been expanding its international presence by entering new markets and strengthening its distribution networks. Emerging markets, especially in Asia and Africa, offer considerable growth potential for the company’s products, given the rising disposable income and urbanization trends.

-

Product Diversification

Pidilite can explore opportunities for product diversification in related sectors. Investing in research and development to introduce new products in niche segments or acquiring companies with complementary product portfolios can help expand the company’s market reach

Threats

-

Intense Competition

Pidilite faces intense competition from both domestic and international players across its business segments. Although it enjoys a monopoly, the Adhesives and Sealants markets due to entry of new players now faces increased competition. Competitors with similar product offerings and pricing strategies pose a threat to the company’s market share and profitability.

-

Economic Volatility

Pidilite’s business operations may be impacted by economic turbulence, such as quickly fluctuating crude oil prices, and geopolitical unpredictability. This includes raw material availability and consumer demand for its products.

-

Regulatory Compliance

Maintaining compliance with numerous regulatory standards and certifications can be extremely difficult. Continuous monitoring and expenditure on compliance measures are necessary to ensure compliance with environmental, health, and safety requirements.

Pidilite Industries Limited has established itself as a dominant player in the market, with a strong brand portfolio and a well-defined marketing strategy. Pidilite’s promotion and advertising strategy have been highly successful, with memorable campaigns and catchy jingles that have made its brands, particularly Fevicol, household names. The company’s focus on brand awareness and effective communication has contributed to its market share growth.

Overall, Pidilite Industries Limited’s strategic approach and commitment to product quality, distribution, and marketing have solidified its position as a market leader in the adhesive, sealants, construction chemicals, and consumer products industries.

Finance World

Why Muthoot Finance is not affected by the small cap and mid cap fall?

This week, if you’ve been keeping an eye on the stock market, you might’ve noticed something unusual. While the small cap and mid cap markets took a serious dive, Muthoot Finance seemed to just avoid it, falling by a mere 2%. So, what’s their secret?

What is the business of Muthoot Finance?

First up, Muthoot Finance has a strong foothold in gold loans. Now, why does this matter? Well, when other investments seem risky, people tend to fall back on gold because it’s considered a safer bet. With gold prices staying high, Muthoot’s gold loan business is like a stable ship in a stormy sea.

Muthoot Finance target price by Kotak

Kotak Institutional Equities is pretty optimistic about Muthoot, recommending a “buy” with a target of Rs 1,500. They think Muthoot is in a prime spot to grab a bigger slice of the gold loan market. Plus, with some Non-Banking Financial Companies (NBFCs) hitting a rough patch, Muthoot has a clear ground to expand and grow further. Unlike NBFC, Muthoot has a strong ground presence with offices and branches, they have physical repo with their customers, unlike NBFC who operate from AC offices.

New Friends and New Frontiers

Muthoot isn’t just sitting pretty with its gold loans; it’s also making moves. It teamed up with Evfin to finance electric two-wheelers across India. And there’s more – Muthoot FinCorp has brought Veefin Solutions on board to kick off supply chain finance operations. This means they’re planning to lend a hand to small and medium businesses, helping them keep the wheels turning. So, its a great news that Muthoot is expanding into fields that are not dependent on gold loans alone.

Spreading Their Wings

Muthoot Microfin, a part of the Muthoot Group, is pushing into new territories too. They’ve just set foot in Telangana and have their sights set on Andhra Pradesh next. This move is about bringing more people into the financial fold, especially in places where banking services might be hard to come by. This gives an edge to Muthoot over banks and NBFC.

Are you wondering whether to invest in Muthoot Finance or Manappuram Gold? Take a look at this:

So, What’s the Deal?

While the market’s mood swings have sent some companies into a pit, Muthoot Finance has managed to stay stable. Thanks to its focus on gold loans, strategic partnerships, and expansion plans, it’s not just surviving; it’s set to thrive. So, while the rest of the market might be catching its breath, Muthoot is marching on, steady as ever.

Keep following us for more such latest news on TradeAlone.

Finance World

Infibeam Avenues Ltd expands into the US Market with an Acquisition

Hello, digital pioneers and fintech enthusiasts! Let’s dive into a groundbreaking announcement for Infibeam. Infibeam Avenues Ltd, an AI-powered financial technology, is embarking on an exciting journey by acquiring a 20% stake in XDuce. XDuce is a mastermind in enterprise Application and AI development based in the United States. This bold move involves an investment of USD 10 million. This also marks a significant milestone in Infibeam Avenues Ltd’s global expansion narrative.

XDuce: A Hub of Innovation

Nestled in the heart of New Jersey, XDuce boasts a team of over 150 software developers. They’re a team behind the curtain for marquee clients like Bank of America and Morgan Stanley, to name a few. XDuce’s expertise in business application implementations and transformation is nothing short of legendary in the financial and insurance sectors of North America.

A Fusion of Giants

So, what happens when Infibeam Avenues Ltd and XDuce comes together? Infibeam Avenues Ltd wants to merge it’s AI Solutions and CCAvenue Payments business into the network that XDuce has built. This collaboration is about expanding business footprints, revolutionizing how AI-driven technologies are employed in fraud detection, authentication, and risk identification in the financial sector of the US.

Redefining Financial Technology

Imagine a world where transaction fraud is no longer a looming threat, thanks to state-of-the-art AI technologies. That’s the vision Mr. Jay Dave, CEO of XDuce, and Mr. Rajesh Kumar SA, CEO of Phronetic.AI, share. By integrating PhroneticAI abilities with XDuce’s solutions, they will offer businesses and consumers in the US with security and efficiency.

The Road Ahead

According to Mr. Vishwas Patel, Joint Managing Director of Infibeam Avenues Ltd, international business currently contributes less than 10% to the company’s total revenue. But with strategic moves like this, they’re aiming for international business to soar to 30% of total revenue in the coming years.

Infibeam Avenues Ltd at a Glance

Infibeam Avenues Ltd is at the forefront of offering digital payment solutions and enterprise software platforms across the globe. With a transaction worth INR 4.5 trillion (US$ 54 billion) processed in FY23, and a client base of over 10 million. Spread across digital payments and enterprise software platforms, they’re leading digital revolution.

Wrapping Up

The strategic investment in XDuce is a bold step towards Infibeam Avenues Ltd’s vision of global expansion and innovation.

Stay tuned with Tradealone, as we continue to follow this exciting journey of Infibeam Avenues Ltd. Stock price for Infibeam closed 7% up today. We also see a continues profit growth for Infibeam Avenues over the past 4 years. Although, we cant recommend a buy or sell call for the stock, however we feel this stock deserves your attention.

Finance World

Satin Creditcare Expands its Reach by entering Telangana and Andhra Pradesh, stock has doubled so far this year

In a country where financial inclusion remains a major yet challenging goal, the expansion of services to underbanked regions marks a significant step forward. Satin Creditcare Network Limited (SCNL), a leading name in microfinance, announces its strategic entry into Telangana and Andhra Pradesh. This move not only amplifies SCNL’s presence to 26 states and union territories across India but also underlines its commitment to empowering the economically marginalized communities with vital financial services.

A Leap Towards Nationwide Financial Inclusion: SCNL’s mission to drive financial inclusion is more than just a business expansion; it’s a pledge to reach the unreached. The opening of two new branches in Telangana (Warangal and Huzurabad) and one in Kadiri, Andhra Pradesh, is a testament to SCNL’s dedication to making financial services accessible to all, especially in rural and semi-urban areas where banking facilities are scarce.

Why Telangana and Andhra Pradesh?

The choice of Telangana and Andhra Pradesh for SCNL’s latest expansion is strategic. Both states have shown promising economic growth yet house significant populations that lack access to basic financial services. By stepping into these states, SCNL aims to fill this gap, offering microfinance solutions that can serve as a catalyst for economic empowerment and sustainable development. Moreover, Telangana is a fast growing hub for Pharma industry as the state capital Hyderabad leads the way.

SCNL’s Blueprint for Empowerment

SCNL’s approach to empowerment through financial inclusion is holistic. Focused on rural India, with 76% of its operations dedicated to rural communities across 97,000 villages, SCNL is not just providing financial services but is also contributing to the rural economy’s growth. This expansion is a stride towards enabling access to credit for the underserved, thereby fostering an environment of economic resilience and growth.

A Message from the Leadership

Mr. HP Singh, Chairman cum Managing Director of SCNL, remarks, “Our expansion into Telangana and Andhra Pradesh is a significant milestone in our journey towards a financially inclusive India. It’s not merely about increasing our geographical footprint; it’s about touching lives, empowering the marginalized, and contributing to the nation’s economic fabric. We’re here to make a difference, one individual, one community at a time.”

Ashirvad Microfinance is a fast growing company as well. Check it out if you are interested.

Beyond Expansion – A Look at SCNL’s Innovations

SCNL’s innovations extend beyond traditional microfinance. The institution’s portfolio includes loans to MSMEs, affordable housing loans through its subsidiary Satin Housing Finance Limited (SHFL), and the commencement of MSME business through Satin Finserv Limited (SFL). These initiatives demonstrate SCNL’s commitment to diversifying financial solutions that cater to various needs of the underserved.

The Road Ahead for SCNL

As SCNL carves new paths in Telangana and Andhra Pradesh, the future looks promising. This expansion is not just about growth but about deepening the impact of financial inclusion across India. With continued innovation and a steadfast commitment to its mission, SCNL is poised to create significant strides in empowering communities and fostering economic development across the country. Moreover, the stock price for Satin Creditcare has almost doubled in the last one year.

Conclusion: SCNL’s expansion into Telangana and Andhra Pradesh marks a new chapter in its mission to facilitate financial inclusion across India. By reaching out to the economically marginalized sections of society, SCNL strengthens its role as a catalyst for economic empowerment and sustainable development. As we watch this journey unfold, the prospects for a financially inclusive India appear brighter than ever. Despite that we do not see any positive signs from the revenue and profit growth of the company over the last 5 years. Thus, we feel that investors must be cautious while investing here.

Remember that microfinance companies also face competitions from the major banks. However, as this move is towards uncharted regions of Telangana and Andhra, we do not think that the banks would pose any risk to Satin Creditcare.

Call-to-Action: We invite you to join the conversation: How do you think SCNL’s expansion will impact financial inclusion in Telangana and Andhra Pradesh? Share your thoughts and insights in the comments below. Let’s discuss how financial empowerment can transform lives and communities. Also, please follow Tradealone for more such latest updates.

-

Profit Making Idea1 year ago

Profit Making Idea1 year agoThe Grandfather Son (GFS) Strategy: A Technical Analysis Trading Strategy

-

Uncategorized8 months ago

Uncategorized8 months agoA BJP victory and the Stock Market: what to expect this monday

-

Technology5 months ago

Technology5 months agoInnovative Metro Ticketing Revolution in Pune by Route Mobile and Billeasy’s RCS Messaging. Stock trades flat

-

editor9 months ago

editor9 months agoHow to research for Multibagger Stocks

-

Trending12 months ago

Trending12 months agoDoes the “Tata-Apple venture” benefit Tata shares?

-

Finance World12 months ago

Finance World12 months agoHow Zomato Turned Profitable: A Landmark Achievement in the Indian Food Delivery Market

-

Market ABC8 months ago

Market ABC8 months agoSpotting an operator game: How to do it?

-

Market ABC1 year ago

Market ABC1 year agoThe Pullback Strategy: A Timeless Approach to Investment Success